[Click on BLUE links for sources and more information]

Cassandra: Beware of Hootie Pie.

Sonia: Who?

Cassandra: I don’t know. Just beware.

Vanya: Hootie Pie. We need to keep a small notebook nearby and write all these things down, for your sanity hearing later.

Sonia: Hootie Pie. Is that a first name, “Hootie Pie”? Or is “Hootie” the first name, and “Pie” the last name?

Vanya: Or maybe Hootie Pie is a pie. And you can order it at a restaurant.

Cassandra: I don’t know what Hootie Pie is. I just know you must beware it.

Vanya & Sonia & Masha & Spike by Christopher Durang

The love affair between investors and stocks is on the rocks. It’s not clear if we need a marriage counselor or a divorce attorney. Maybe we need a voodoo doll swinging soothsayer like Cassandra. Or maybe all we need is a little common sense.

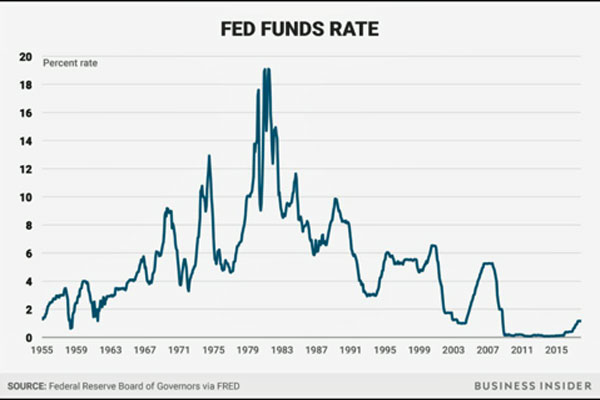

Take a look at this graph (courtesy of our friends at Global Macro Monitor) that shows the value of all U.S. stocks relative to GDP (gross domestic product, i.e. total economic output). Stock prices compared to the economy have more than doubled since the great financial recession of 2008 (recent market declines are not included).

One simple explanation for the meteoric rise in stock prices is that interest rates have been near zero for the past decade. The low interest rates are not a natural consequence of a freely operating economy. They are the result of a Federal Reserve policy that was designed (correctly in my opinion) to avert an even more serious recession after the 2008 collapse. But, these low rates have gone on so long, too long, that they’ve distorted the prices of interest sensitive assets like stocks and real estate.

Stock prices depend on many factors. One of the most important is the “present value” of “expected future corporate earnings.” The present value is the amount a rational investor would pay today to receive a certain amount in the future. (Earnings are not certain, but we won’t dwell on that for now.) Here is a simple example. Suppose interest rates are 4%. How much would an investor pay for $104 one year from now? Answer: $100 (since $100 invested at 4% accrues to $104 in a year). Suppose interest rates fall to 1%? Since $100 invested for a year now accrues to only $101, the expected $104 must be worth more than $100 today (approximately $103 since $103 invested at 1% for a year accrues to $104).

Bottom line: all other things equal, a decline in interest rates will raise the present value of stocks and real estate and other interest sensitive assets. The relationship also works in reverse, a rise in interest rates will lower the present value of interest sensitive assets.

So one reason stock prices are falling is that interest rates are rising. Why not just keep interest rates low indefinitely? The answer, if interest rates are kept too low too long, bad things can happen (like inflation and asset price distortion). President Trump blames today’s stock market decline on the Federal Reserve’s current policy of raising (“normalizing”) interest rates. There is some truth in that just like there is some truth in saying that the previous stock market rise was the result of the Federal Reserve’s policy of lowering interest rates. Stock prices rise and fall for many reasons, not just interest rate fluctuations. Blaming the stock decline on the FED raising rates is like saying you could drive a lot faster if you unhooked your brakes. Maybe, maybe not, but unwise.

Sea Gull Cellar Bar Napkin Art, Roy Hoggard artist

Economist Daniel Lacalle recently tweeted:

“After the Fed rate hike, opportunities appear. As investors, we need to stop thinking of monetary stimulus and more about fundamentals. Markets need to get used to rate hikes. Don’t blame the Fed. Blame the previous excess. The productive economy can take it. Bubbles will not.”

As the first graph in this post shows, stock prices may well be in a bubble. I won’t go through all the other data to support the bubble hypothesis. What I will do here is make a few comments about the other half of the equation that helps determine stock prices, expected future corporate earnings.

The Republican tax cut last year was a boon to corporations. That is, most of the benefits (to date at least) have gone to corporate profits and the wealthy. Think in the Morning predicted this HERE and has discussed it further in other posts. The increase in expected future corporate earrings from the tax cut were one factor in the rise in stock prices. Now, with Democrats soon to be in control of the House, future tax cuts are less likely. The current tax cut could even be reversed. Partially as a result, stock prices have begun to decline.

Regulatory reform sounds good. Who wants their business or life regulated? While regulations can be a nuisance, they are one of the few ways we can correct corporate misbehavior–environmental destruction, employee abuse, and other “economic externalities.” If businesses do not have to pay the cost of cleaning up after themselves, if they can get the upper hand in employee relations, if they can cheaply buy up public resources like the national parks and so on, profits will increase. This is another reason for the rise in stock prices over the past couple of years. But, many clear-eyed analysts understand that such profits are temporary. Sooner or later someone will have to pay. The same is true with the government debt that has been increasing at a rapid rate. As investors realize that corporate profits may not be as robust in the future as they hoped, stock prices can adjust.

Finally (for now), uncertainty about the future is increasing. Large divisions among voters and citizens are making us reconsider the viability of our very democracy. Lies and hypocrisy have become commonplace and respect for truth and science has bee diminishing. As we pen this post, chaos in Washington is front and center with the possibility of another government shutdown.

Rising rates, recognition that corporate profits were pumped up artificially in some cases and that many of the regulations rolled back by the current administration will have deleterious effects on our lives, and high levels of uncertainty–it’s no wonder that stock prices are declining. And, the decline could go on for quite some time although I am no Cassandra. At times like this it’s good to remember Stein’s Law (named for the economist Herbert Stein): “if something cannot go on forever, it will stop.” A marriage counselor is surely the remedy here, not a divorce attorney. Eventually investors will again gain the confidence to buy stocks.

However, one must also have a short run plan. As another famous economist, John Maynard Keynes, pointed out:

The long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again.

For that all important short run plan I advise you to speak with your investment advisor and other professional advisors. This isn’t a time to bury your head in the sand.

I’ve always loved reading your stuff, and never bothered to thank you. But today in particular, I want to tell you, how special you are. So, Thanks!

I miss our get together. You never showed me how to shoot flies with a rubber band. Hi to Jennie and congratulations.