There ain’t no such thing as a free lunch

Jesus said unto him, If thou wilt be perfect, go and sell that thou hast, and give to the poor, and thou shalt have treasure in heaven: and come and follow me.

But when the young man heard that saying, he went away sorrowful: for he had great possessions.

Then said Jesus unto his disciples, Verily I say unto you, That a rich man shall hardly enter into the kingdom of heaven.

And again I say unto you, It is easier for a camel to go through the eye of a needle, than for a rich man to enter into the kingdom of God.

Matthew 19:21-24

Back in my financial planning days, a client came to me who took early retirement. I asked him what preparations he’d made for a secure retirement income. Oh, that’s easy, he said. I just refinanced my home here on the coast. The equity I took out will support me for a few years. I asked him how he was going to make the mortgage payments. I’ll just take them out of the cash I got from the loan, he said. I asked him what he would do when the cash from the loan runs out. No problem, he said. I’ll just and take out more equity. The value of the house keeps going up.

I tried to convince him that his plan would fail if real estate prices took a fall or if interest rates increased dramatically but he was convinced neither of those things would happen. I tried to explain that banks loaned based on income, not on the value of assets but again he discounted my advice. In the end we parted ways. I saw a train wreck waiting to happen that I couldn’t avert and I didn’t want to be around for the wreck.

A few years later he came back to set up a pension plan. He was back at his old job but as a subcontractor without the benefits. He sold his house on the coast but taxes and the mortgage ate up the proceeds. Hopefully, if he continues to work and save, he will eventually retire comfortably but later than he once hoped.

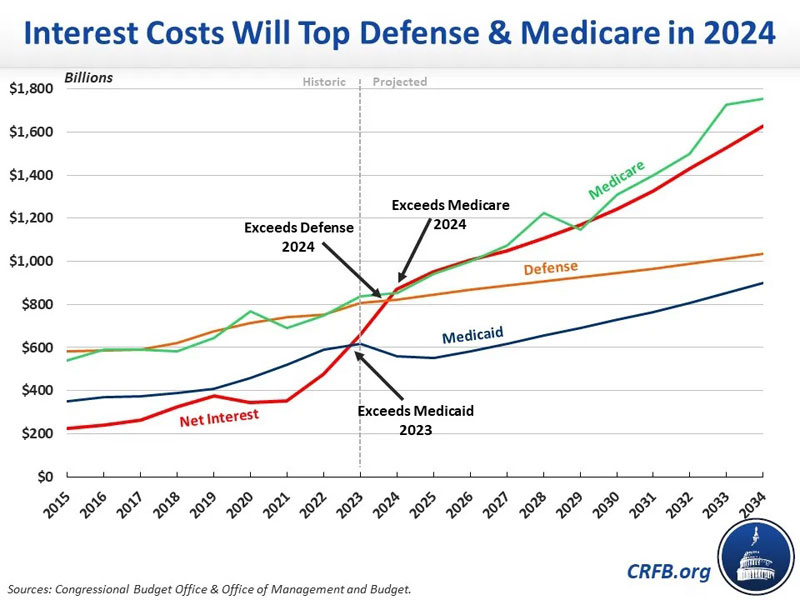

During a recent town hall, former United Nations Ambassador and current Presidential candidate Nikki Haley claimed: “for the first time we’re paying more in interest payments than we are on our defense budget.”

This is true but the question is is it something to worry about? Yes and no. As so often is the case, it depends. Countries and families are not the same when it comes to saving and spending.

About three quarters of our national debt is owed to ourselves. Pension funds (including Social Security), endowments and wealthy individuals are the creditors. Technically we are all debtors. The 25% of our national debt owned by foreigners is more of a concern. But, at least for now, both domestic and foreign investors seem willing to hold U.S. government debt. Is it possible the federal government can continue to finance its debt without any serious effort to pay it back? Maybe.

There are perfectly good reasons for the government to borrow. Government debt can be used to stabilize the economy. For example, during times of recession and severe economic shocks like the pandemic it might make sense for the government to run a deficit to prevent a worse recession or a depression. Theoretically a government surplus could slow the economy when inflation threatens. There is no guarantee the deficits and surpluses will balance over time. They could theoretically but for pretty obvious political reasons they don’t balance in practice. The last time the government budget was in surplus was 2001. It turns out both Republicans and Democrats like government deficits either to provide tax benefits for the rich or to provide much liked spending programs for everyone.

Unlike most families, the government has the ability to raise taxes to help pay its debt. It also has the ability to print money to pay the debt. It also has some flexibility to keep interest rates low thus reducing the interest payments on the debt. All of these tactics can increase inflation and/or reduce demand for government bonds, so they are not risk free.

Much government spending is actually investment for the future (infrastructure, education and so forth). It makes some sense to pay over time for improvements that will provide benefits over time.

The arguments about goals and means have been with us from the beginning of time and will likely be with us until the end of time. Are tax benefits for the rich to be preferred to educational benefits for our children? Is debt repayment and lower interest costs to be preferred to a handout/hand-up for the homeless, destitute and the poor? Hard questions. No right or wrong answers.

There is no such thing as a free lunch. Somebody pays or we all share the cost. Treasure in heaven is a long way off for someone who prefers the jingle of jade pendants. America is a Christian nation but not too Christian. Perhaps with AI we’ll figure out how to get that camel through the eye of a needle. America is a capitalist nation but not too capitalist. In the words of Alfred Doolittle: “The Lord above gave man an arm of iron so he could do his job and never shirk. The Lord above gave man an arm of iron, but with a little bit of luck, with a little bit of luck someone else’ll do the blinkin’ work.”