Fire and Ice

Robert Frost

Some say the world will end in fire,

Some say in ice.

From what I’ve tasted of desire

I hold with those who favor fire.

But if it had to perish twice,

I think I know enough of hate

To say that for destruction ice

Is also great

And would suffice.

Robert Frost published Fire and Ice one hundred years ago. Today, in financial terms, we are grappling with a similar existential question: Hyperinflation or deflation? Like Frost, the only thing we can say for sure is that either could do us in.

If the self-imposed lockdown designed to limit the spread of coronavirus causes sufficient damage to the economy, deflation could be in the cards. A number of businesses, small businesses in particular, have permanently closed. Landlords are finding it hard to collect rents. Banks are putting loan payments on hold. Insurance companies are sending out refunds because travel has declined. Sales are down and unemployment is up. As the saying goes, the difference between a recession and a depression is whether it’s your neighbor or you who’s losing a job. In a deflation it’s debtors who lose and lenders who win but ultimately both lose as debtors go bankrupt. You can’t squeeze blood out of a turnip. I recommend Christina Stead’s House of All Nations as one novel I enjoyed about deflationary times although there are many to choose from. You will learn a little about economics from her novel and a lot about people and human nature. Lessons never wasted.

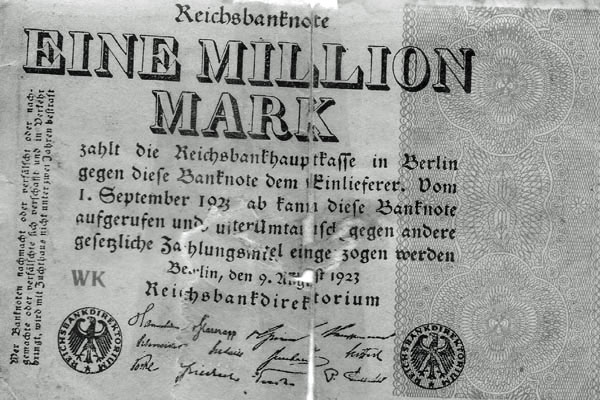

To avoid the dreaded deflation, the Federal Reserve has been printing money at a rapid rate and the Federal government has been spending like there’s no tomorrow. Interest rates are near zero and there’s talk of them going negative. Banks pay you to borrow money that you likely will not pay back. In more colorful words, they pay you to screw them. In the old days, too much money printing led to inflation and sometimes hyperinflation and that’s no picnic either. But, it’s easier to stop than deflation. Just swap out the old currency and replace it with new. As with musical chairs, when the music stops some people won’t have a chair to sit in but the music will stop. My favorite novel about hyperinflation is The Black Obelisk by Erich Maria Remarque. If you think we’re going down the hyperinflation path, Remarque gives you some pointers about how to cope, but it’s a great book to read even if hyperinflation never occurs again.

Million Mark Note, Errol Miller collection

One of the first things I learned in economics is how remarkable the price system can be in organizing demand and supply, production and distribution. During normal times it is prices that keep the economy humming along to most everyone’s benefit. Prices when properly determined are signals that denote scarcity and abundance, what, how and for whom to produce. Properly determined means freely and independently in a competitive arena where buyers and sellers have access to accurate information and reasonable foresight. Today in the financial markets I would argue we lack properly determined prices. Massive money printing (i.e. QE=indiscriminate bond buying) has raised the price of bonds and lowered interest rates to levels that would have unlikely been determined by free and independent buyers and sellers. Prices today, especially in the financial markets, may not be the efficient signals economics textbooks make them out to be. How this will influence the future is unknown. I wouldn’t put my cards on a Goldilocks ending but anything is possible.

Fire and ice, hyperinflation and deflation, these have not been the common history of our capitalist system. Both have occurred and could occur again, maybe sooner rather than later. I’m keeping my fingers crossed but my options open. It’s no time to throw caution to the wind in my humble opinion. I may be wrong but at least I’ll have my kite to fly another time.