[Click on BLUE links for sources and further information]

Billionaire Michael Bloomberg, erstwhile Republican now Independent, has an article out today This Tax Bill Is A Trillion-Dollar Blunder. It’s a “must-read” for anyone who cares about our economy, our country, and our democracy. After dismantling the Republican arguments that the tax bill will “jump-start the economy” and “lead to significantly higher wages and growth”, he very clearly points to the real problems we need to face:

“The largest economic challenges we face include a skills crisis that our public schools are not addressing, crumbling infrastructure that imperils our global competitiveness, wage stagnation coupled with growing wealth inequality, and rising deficits that will worsen as more baby boomers retire.”

The skills crisis, crumbling infrastructure, and rising deficits are issues that impact the economy in well-understood ways. Bloomberg briefly discusses how the tax bill that is almost sure to be passed next week fails to address these issues and in many cases makes them worse. The relationship between growing wealth inequality and the economy is more complicated.

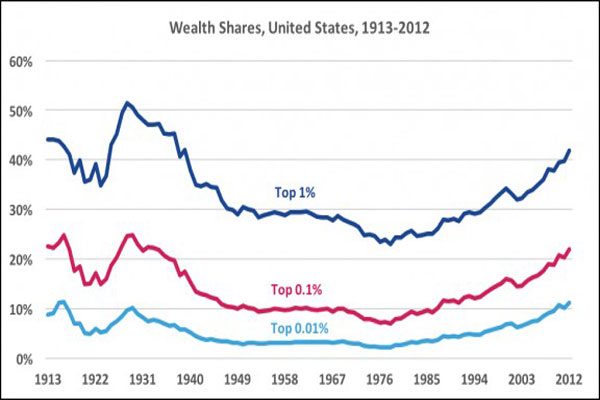

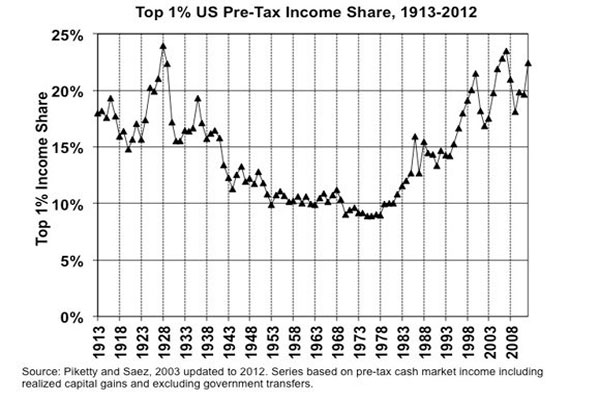

America’s two worst economic catastrophes in the last century, the Great Depression starting in 1929 and the Great Recession starting in 2008 occurred at a time when both income and wealth had become enormously concentrated. Inequality decreased after the Great Depression. Since the Great Recession, inequality of both income and wealth has increased, not decreased. Is this a problem and if so why?

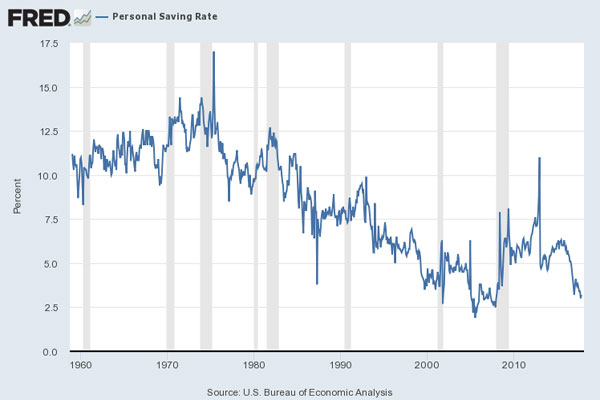

The mechanism through which inequality impacts the economy is not well understood. One argument is that inequality reduces consumption since the rich save more than the poor. As inequality increases, the concern is that there will be inadequate demand in the economy to encourage growth. Because real wages have not increased for years, consumers have reduced savings to a minimum and increased debt loads to dangerous levels in a futile attempt to keep up with the rich and famous. Bolstering the economy with reduced savings and debt has likely reached its limit.

The Republican argument that businesses need a tax cut as an incentive to invest and raise wages seems rather shallow given that “corporations are sitting on a record amount of cash reserves: nearly $2.3 trillion” according to Bloomberg. Corporations well understand that consumers are maxed out and that producing more will likely build up inventory rather than adding to sales.

Another concern with inequality is that it leads to concentration of power through monopoly and bigger and bigger businesses. Bigger isn’t better in this context and such concentration can lead to inefficiency and complacency instead of the competitive framework that capitalism is supposed to encourage.

Much of the unspent cash sloshing through the economy ends up in asset speculation. Businesses buy back shares and the wealthy invest their excess savings in shares of stock, bonds, commodities, and novelties such as the bitcoin bubble. President Trump enjoys taking credit for the rise in asset prices but the real reason asset prices are rising is that there is an enormous amount of unspent cash floating around in search of someplace to land. The Federal Reserve laments the lack of inflation in the prices of goods and services when in reality the inflation is right in front of their eyes in the asset markets. This is not healthy for the economy. It will be downright dangerous when the bubble collapses as all bubbles eventually do.

Finally, inequality in the extreme undermines belief in the fairness of the economy and this leads eventually to political unrest and worse.

The tax bill likely to be passed next week poses a danger to all of us. The rich get richer while the poor struggle to get along. The initial plan to repeal the estate tax has been watered down. The estate tax remains in place but the exemption level has been greatly increased. Great wealth inherited without restriction leads over time to aristocracy, the very thing the first European settlers came here to avoid.

What can be done? I have very little hope at this point other than that a few sane Republicans will ride in on a carriage pulled by white horses next week and bring some common sense to the discussion—a very unlikely event.

Another terrific column on economics. You bring in Bloomberg and sound a lot like Krugman and this is all to the good. I have quoted some of your columns to my friends. Thanks for your good work, David.

…I stand with thee my friend…

I fear there are no and republicans left in Washington…..white horses…becoming extinct.