Inflation is back in the news and for good reason. We are on the brink of testing a well-worn phrase, “inflation is always and everywhere a monetary phenomenon,” first coined by Milton Friedman back in the sixties about the time I graduated from high school. As it turns out, I wrote an economics paper while in college on lags in the effects of monetary policy–wonky stuff both then and now. Friedman maintained that rapid monetary growth would increase inflation but with a lag that was both long and variable. A long and variable lag makes prediction difficult especially when other things are happening along the way.

I studied economics in college. I also studied statistics. One of the best statistics books you can read is Darell Huff’s How To Lie With Statistics published when I was eight years old. I didn’t read it until I was twenty. I haven’t checked but I’m pretty sure he wrote somewhere in the book something like “any good statistician can take any set of data and make it say anything he wants.”

So, here we are like Dante lost in the midst of a dark wood with squishy data and a long and variable lag in the impact of policies we are trying to sort out. I will paraphrase here Supreme Court Justice Potter Stewart’s comment on obscenity to describe my view of inflation: “I know it when I see it,” and I see it. An equally wise man I once heard put it like this:

It’s in the water

It’s in the air

It’s in the food

It’s everywhere

We Cracked Pots Have A Sense Of Humor, Think in the Morning

In fact, that we have inflation that is the highest in years and growing is not in dispute. What is in dispute is why and how long it will last.

Some say it’s because of supply constraints. Others blame excess demand. Still others cite excessive growth in the money supply. We first saw inflation in asset prices (stocks, bonds, real estate) and now it’s showing up in consumer items (fuel, food, housing costs).

Some say not to worry, inflation is transitory and will go away when the supply chain is straightened out. Others say government spending is causing out of control demand, tamp that down and inflation will go away. Still others say it’s the FED throwing too much money at too few goods a la Milton Friedman. Stop the helicopter drops of cash and inflation will recede. But indisputably, with good ole Justice Stewart, we know it when we see it, and it’s here.

Eventually we will find out who is right but that will prove to be of little comfort as we find ourselves faced by new intractable problems. What will they be? Erich Maria Remarque wrote The Black Obelisk where fascism grows out of the deflation that follows hyperinflation. Some say that we are very far from any of that today. Others fear we are very close.

The lesson I draw is adapt or die. Those who like Pasternak’s villain, Viktor Komarovsky, in Doctor Zhivago learn to play both sides will survive. Those who like the Jesus of Albert Schweitzer’s quest oppose the march of history will be crushed.

There is silence all around. The Baptist appears, and cries: “Repent, for the Kingdom of Heaven is at hand.” Soon after that comes Jesus, and in the knowledge that He is the coming Son of Man lays hold of the wheel of the world to set it moving on that last revolution which is to bring all ordinary history to a close. It refuses to turn, and He throws Himself upon it. Then it does turn; and crushes Him. Instead of bringing in the eschatological conditions, He has destroyed them. The wheel rolls onward, and the mangled body of the one immeasurably great Man, who was strong enough to think of Himself as the spiritual ruler of mankind and to bend history to His purpose, is hanging upon it still. That is His victory and His reign.

Schweitzer, Albert. The Quest of the Historical Jesus

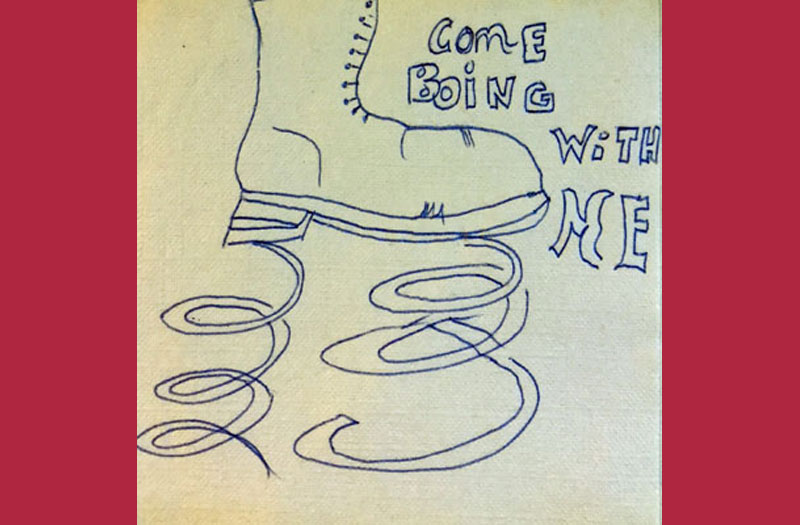

I first read of a great Islamic saying while thumbing through a book by G. I. Gurdjieff: “Trust in Allah but tie your camel first.” That, my friends, is what I recommend before you get boinged.

For Further Reading:

Feels Like 1977: Inflation Too High, Money Too Loose

Monetary Policy, Money and Inflation

Where Inflation Is The Highest in U.S.

The Specter of Hyperinflation: Remarque’s The Black Obelisk

Nice post but what does King David think?

P.S…almost all the hyperinflation periods throughout history have been transitory, possibly except current Venezuelan hyperinflation inflation. So “Team Transitory” is being a bit disingenuous. I think U.S. could be headed toward an Israeli mid-1980s high inflation extended period if the Fed wimps out. If they panic and abruptly change policy, the extremely overvalued and farcical asset markets collapse, and same time next year, the worried discussion will be about deflation. The asset dependent global economy hooked on easy money is in a very unstable equilibrium, King David. Just my two bitcoins.

Your “very unstable equilibrium” has obvious political as well as economic consequences as explained by Keynes who claimed to be quoting Lenin when he said “the best way to destroy the capitalist system is to debauch the currency.” It is the political consequences that I worry most about. We have been tottering on the brink of fascism for some time now. The unstable equilibrium you rightly describe only adds to the risk that we will fall off the edge. Can all the King’s horses and all the King’s men put Humpty Dumpty together again? In this hyper partisan world? I’m beginning to doubt. And, as William Blake cautioned us “if the sun & moon should doubt, they’d immediately go out.”

Thank you for another great piece!!

I have to admit that I didn’t imagine that boinged referenced the economy.

Yep, you got it.