[Click BLUE links for sources and information]

A year and a half ago TITM posted: Bonehead Economics: Things to Know in the Era of Trompudo. Today, once again, the lack of clear thinking is leading us down a problematic road. The Nobel economist, Joseph Stiglitz, recently penned an article confirming most of what we argued in our older post: The US is at Risk of Losing a Trade War with China.

Sea Gull Cellar Bar Napkin Art, Bob Seager artist

In Bonehead Economics we showed how the country’s trade deficit and the government’s budget deficit are related, something Stiglitz emphasizes in his article:

First, macroeconomics always prevails: if the United States’ domestic investment continues to exceed its savings, it will have to import capital and have a large trade deficit.

Worse, because of the tax cuts enacted at the end of last year, the US fiscal deficit is reaching new records – recently projected to exceed $1 trillion by 2020 – which means that the trade deficit almost surely will increase, whatever the outcome of the trade war.

The US has a problem, but it’s not with China. It’s at home: America has been saving too little. Trump, like so many of his compatriots, is immensely shortsighted. If he had a whit of understanding of economics and a long-term vision, he would have done what he could to increase national savings. That would have reduced the multilateral trade deficit.

Sea Gull Cellar Bar Napkin Art, Max Efroym artist

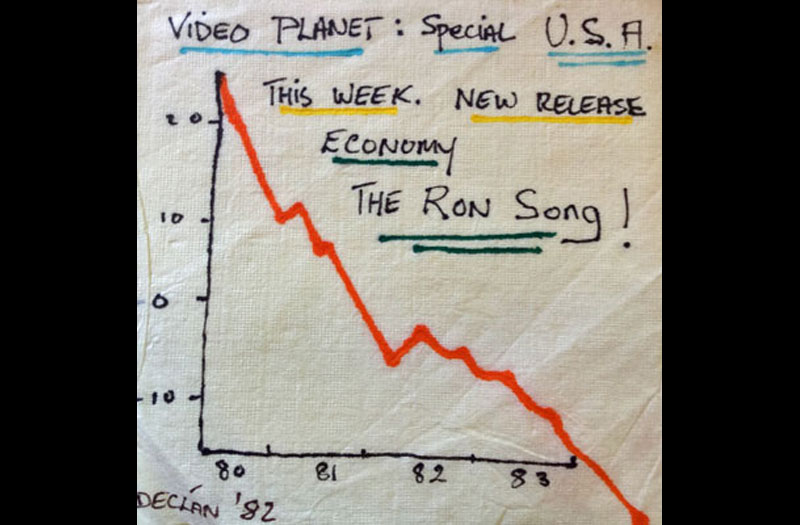

Trompudo likes to compare himself to the Republican icon, Ronald Reagan. While Reagan is remembered as a President who delivered a period of sound economic growth, we tend to forget that in the second year of Reagan’s term the United States suffered a major economic recession with unemployment reaching levels not seen since the Great Depression. Furthermore, during the Reagan era the annual government deficit doubled as a percentage of GDP and government debt tripled from around one trillion to nearly three trillion. The trade deficit increased through most of the Reagan years.

Sea Gull Cellar Bar Napkin Art, Bob Avery artist

Don’t get me wrong. The recession in Reagan’s second year was largely the result of historically high interest rates designed to curb inflation. When Trompudo took the reins, both interest rates and inflation were at historic lows. There are other major economic differences between the Reagan period and Trompudo’s regal reign as well documented by our friends over at Global Macro Monitor (see this is NOT the Reagan stock market).

Sea Gull Cellar Bar Napkin Art, Roy Hoggard artist

However, there are other good reasons to worry about an overheated stock market and the poorly conceived tariff policies of our narcissistic, double down, faux “deal-making” President. Stiglitz mentions them in the article cited above (a must read) and so does Global Macro Monitor (see Reagan’s “Boy Wonder” Nails it on Trade).

Sea Gull Cellar Bar Napkin Art, Roy Hoggard artist

Go back and read our Bonehead Economics and you will see the connections with today’s news. We don’t know where things are going. No one does. Reagan survived the disastrous (for Republicans) midterm election in 1982 and Trompudo may well survive any unpleasant (for Republicans) surprises that occur in 2018. As Stiglitz says:

Trump has shown how he responds when his lies are exposed or his policies are failing: he doubles down. China has repeatedly offered face-saving ways for Trump to leave the battlefield and declare victory. But he refuses to take them up. Perhaps hope can be found in three of his other traits: his focus on appearance over substance, his unpredictability, and his love of “big man” politics. Perhaps in a grand meeting with President Xi Jinping, he can declare the problem solved, with some minor adjustments of tariffs here and there, and some new gesture toward market opening that China had already planned to announce, and everyone can go home happy.

In this scenario, Trump will have “solved,” imperfectly, a problem that he created. But the world following his foolish trade war will still be different: more uncertain, less confident in the international rule of law, and with harder borders. Trump has changed the world, permanently, for the worse. Even with the best possible outcomes, the only winner is Trump – with his outsize ego pumped up just a little more.

What should be monitored is the widening inequality, atmosphere of greed and growing government deficits. The “animal spirits” of investors tend to get out of hand at market tops and bottoms. Prices tend to extremes (see A favorite Warren Buffett market metric is at an all-time high). Extremes eventually lead to reversals. It’s called “mean reversion.” So, as I’ve often told my sons, “Believe in Allah but tie your camel first.” (G.I. Gurdjieff possibly quoting Mohammed)

Sea Gull Cellar Bar Napkin Art, Roy Hoggard artist

Love it!

Thanks Loren, watch those jet skis !