[Click on BLUE links for sources and information]

Disclosure: I have no particular insight into the financial markets. In this I am in good company (just read the financial press for a battery of conflicting reports). Just a couple of weeks ago the famous bond market inversion caused some market gurus to forecast a recession while others see clear sailing ahead. The fact is, those who do have insight into the financial markets are loathe to make a prediction since such predictions are often wrong.

Now, most economists aren’t predicting a recession here, for good reason. The truth is that nobody is very good at calling turning points in the economy, and calling a recession before it’s really obvious in the data is much more likely to get you declared a Chicken Little than hailed as a prophet. (Believe me, I know all about it.) But the bond market, which doesn’t worry about such things, is looking remarkably grim. I leave the possible political implications as an exercise for all of you. Paul Krugman, The Bond Market Is Screaming, Weekly Newsletter

In spite of the risks outlined by Paul Krugman and my lack of expertise, I do have my opinions and will go on the record here for the heck of it. The bond market is in a bubble. Stock prices are rising because there’s no other game in town. Call it “spending forward”. Trashing our environmental laws, lowering taxes for the rich and raising our deficit to over a trillion, cutting back on humanitarian obligations, reducing government regulations and corporate oversight … all these things cut costs up front and leave the mess for the next generation. Do we really think negative interest rates are going to help when the chickens come home to roost?

Fact is, I’ve been on the wrong side for a long time. I’m uncomfortable with valuation levels as anybody who has studied financial history should be. There is just too much complaisance out there to allow me to get comfortable. I can’t help but think of the immortal words of ex-Citybank CEO Chuck Prince.

“As long as the music is playing, you’ve got to get up and dance.”

Well no, you don’t, but if you don’t dance you might be left out for a while, an uncomfortable feeling you will have to live with. Back when I was a restaurant/bar owner, we had live music in the Sea Gull, a popular Mendocino watering hole. I met a lot of musicians. One I fondly remember is Steve Seskin. He wrote a hit song by John Michael Montgomery called Life’s A Dance. You may have heard of it.

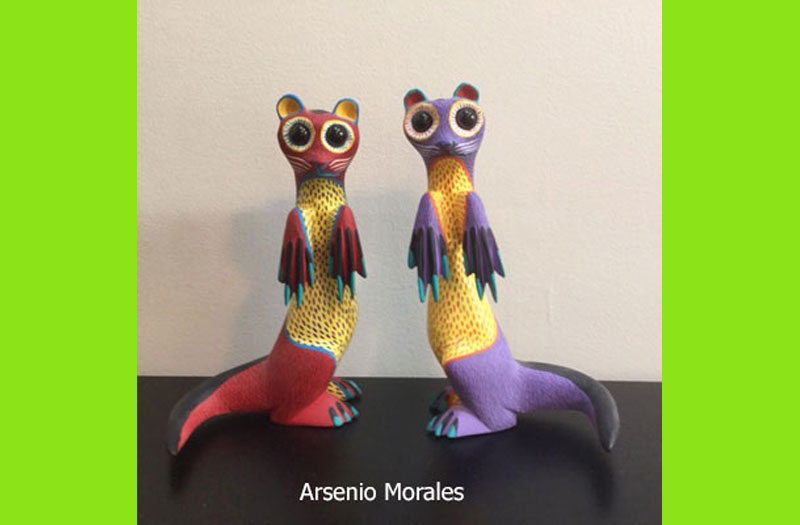

No one knows what pop goes the weasel means but the best explanation is that it too was a dance fancied no less by the Queen of England. A newspaper advertisement by Boosey and Sons in 1854 suggests that Queen Victoria was influential in the popularity of the dance: “The new country dance ‘Pop goes the weasel’, introduced by her Majesty Queen Victoria.”

There are darker explanations.

The original theme seems to have been a darkly humorous vignette of the cycle of poverty among workers in the environs of London. The “weasel” may refer to a spinner’s weasel, a mechanical yarn measuring device consisting of a spoked wheel with an internal ratcheting mechanism that clicks every two revolutions and makes a “pop” sound after the desired length of yarn is measured. “Pop goes the weasel”, in this meaning, describes the repetitive sound of a machine governing the tedious work of textile workers toiling for subsistence wages. In the context of the rhyme then the first three lines of each verse describe various ways of spending one’s meager wages, with “pop goes the weasel” indicating a return to unpleasant labour.

Or:

Weasel is derived from “weasel and stoat” meaning coat. It was traditional for even poor people to own a suit, which they wore as their ‘Sunday Best’. When times were hard they would pawn their suit, or coat, on a Monday and claim it back before Sunday. Hence the term ” Pop goes the Weasel“

Although its date of origin is unclear, “Pop! Goes the Weasel” has its geographical roots clearly in London. The City Road and Eagle pub are identifiable landmarks, and it’s believed that the rhyme uses traditional rhyming slang — “weasel” being Cockney shorthand for “weasel and stoat,” which means “coat.” “Pop” is a colloquial term for pawning, so the first verse suggests the gaining of food money by trading in a coat…. this nursery rhyme still versifies a harrowing dilemma: the choice between eating and heating.

Then there are those Jack in the Box toys where a weasel pops up on a spring when a lever is released. Whatever you make of “pop goes the weasel” a pop in either direction is what can happen in the financial markets when things get out of whack. Are they out of whack now? Maybe.

The plan I keep hearing from our leaders is that near zero interest rates will encourage us all to borrow money and spend thereby boosting the economy. It might work. Maybe I should participate. After all, at my age I’ll never live long enough to pay back any money I borrow today. I’ll leave it for my kids to pay it back. Just like we are leaving them a dirtier, meaner, greedier world.

Like I said at the beginning, I have no special expertise in these things. Some of the people who do have expertise agree with me and others disagree. That’s what makes a market. Depending on declining interest rates to goose the economy is a one trick pony that won’t ride if we fall into what J. M. Keynes called a liquidity trap. Are we there yet? Maybe.

Bashing the environmental laws, lowering taxes on the rich, selling off the national parks and off-shore drilling rights and cutting back on humanitarian aid both locally and overseas can provide an initial pop to the economy but these are one-offs and we’ve been there, done that. Maybe it will be enough to unleash those “animal spirits” that Keynes said could boost consumer and business confidence but I have my doubts.

One problem is that income and especially wealth have become so skewed toward the one percent that the average Joe is questioning the myth that has held our capitalist society together. If the rich get richer and the poor get poorer (relatively), that doesn’t bode well for cohesiveness in society.

For the details and data to back up my concerns I recommend Why Rigged Capitalism is Damaging Liberal Democracy by Martin Wolf (hat tip to our friend over at Global Macro Monitor).

I really don’t know where we go from here but I’m worried. I agree with my friend Steve Seskin, life is a dance. I generally like to dance but when the action reaches a dervish pace, my conservative side counsels caution. I think I’ll sit this one out for now.

So there, I’ve said it. I could be entirely wrong about all of this. Do your own research and draw your own conclusions. If you have a long time until retirement you might have the luxury to ride out any volatility that lies ahead. If retirement is just around the corner or if you are already there you might come to a different conclusion. But don’t take my word for it. Ultimately, it’s your choice. No pain, no gain goes the old saying. Just be sure you can stand the pain when the weasel goes pop.

“I made my money by selling too soon.” – Bernard Baruch

I remember hearing a sad slow song by Steve Seskin on the radio like 40 years ago that stuck in my head and I still hum it every once in awhile. Amazingly in this age of access to everything, I can’t find it listed anywhere. In case your friend is the same Steve Seskin, can you ask him about it for me?

The main part that I remember goes, “Worried about you, baby/ That didn’t sound like you, baby/ Worried about you, bay-bee.”

Marco, I reached out to Steve and got this response.

Hi David,

It’s great to hear from you! I hope retirement is going well. I will be up your way in Nov doing a retreat for songwriters at Sea Ranch. I may reach out then to see if we can get together.

Steve ps I did write Worried About You

I just loved that video!!!

Thanks,

Rhoda