[click on blue links for further information]

Dickens Quotes courtesy of The Telegraph

“Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.” Charles Dickens, David Copperfield

Tip O’Neill, the third longest serving Speaker of the House in American history, coined the phrase “all politics is local.” It’s a good phrase but not strictly true. Americans look at many things when election time rolls around. Remember Ronald Reagan’s “are you better off” speech? “Ask yourself, ‘Are you better off now than you were four years ago? Is it easier for you to go and buy things in the stores than it was four years ago? Is there more or less unemployment in the country than there was four years ago? Is America as respected throughout the world as it was?”

“Well!” observed R. Wilfer, cheerfully, “money and goods are certainly the best of references.” Charles Dickens, Our Mutual Friends

In the recent election Americans focused on how miserable they were. It turns out they were pretty miserable. So miserable, in fact, that they elected a man in spite of his obvious character flaws and lack of experience, a man whom they decided would make America great. Again. The again is important. It implies America was great once. When was that? It depends on how you define “great” and how you slice and dice the “facts” assuming you are among those who still look at “facts.” Our friend Gary over at Global Macro Monitor recently wrote a fascinating post on Presidential Stock Market Returns. In the post he said this: “Conflating facts with opinions or not being able to distinguish the difference between the two are the very reason our democracy is faltering, in our opinion.” Those wise words echo the famous quote by Daniel Patrick Moynihan: “Everyone is entitled to his own opinion but not to his own facts.” Moynihan was an ambassador, a senator, and an adviser to four presidents. He was a Democrat who could work with Republicans. God, how I wish he was around today.

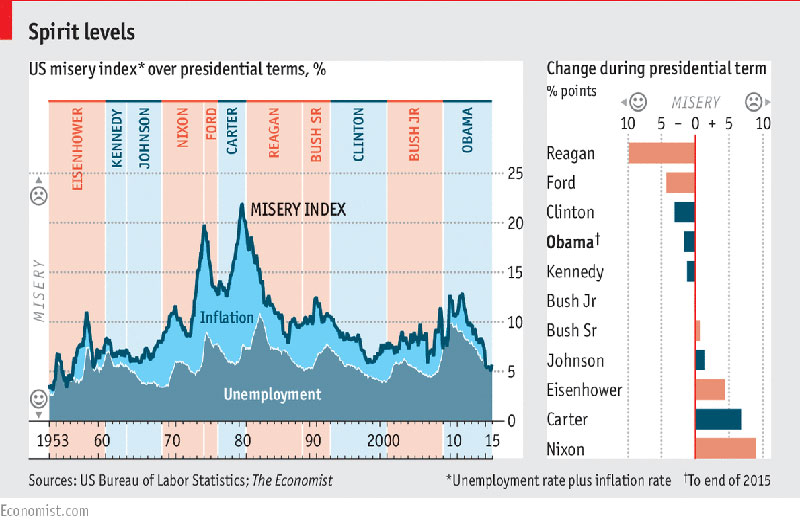

Leave it to the economists to invent a way to measure misery. The misery index—computed by simply adding together America’s inflation and unemployment rates—has been a popular way of expressing national economic performance since the 1970s. A graph of the misery index headlines this post. Whether a president can take the sole credit for improvements (or blame for deterioration) is another matter; Congress and, even more so, the Federal Reserve, have a big impact …The incumbent president, Barack Obama, ranked a respectable fourth in the table as he began his final year in office.” This, according to the Economist.

So, what gives? If the misery index improved under President Obama and if the stock market experienced a significant rally as evidenced by Global Macro Monitor, why did the Democrats do so poorly in the election? The Misery Index, while indicative, is not definitive of a President’s performance or of voters’ perceptions. Two immediately obvious problems are that neither inflation nor unemployment are perfect measures themselves. No such perfect measures exist. Judgments must be made.

“We spent as much money as we could, and got as little for it as people could make up their minds to give us. We were always more or less miserable, and most of our acquaintance were in the same condition. There was a gay fiction among us that we were constantly enjoying ourselves, and a skeleton truth that we never did. To the best of my belief, our case was in the last aspect a rather common one.” Charles Dickens, Great Expectations

Inflation is a general increase in prices and wages. If all prices and wages rise at the same rate, people would be more or less unaffected in that they could buy the same things they bought before in the same quantities. [This abstracts from the impact of inflation on wealth and on trade.] Prices of all goods and wages seldom go up or down at the same rate and herein lies the problem. People don’t all buy the same goods or work for the same employer so any measure of inflation will likely vary in accuracy from person to person. The Big Mac index was a “tongue in cheek” attempt by The Economist to determine if currency exchange rates were at their “correct levels.” It indicates that the Chinese currency is undervalued relative to the U.S. dollar, something Donald Trump and his supporters have been complaining about. The Big Mac index also shows that the government’s measure of inflation appears to be too low. Some people argue this is because the government has an incentive to underestimate inflation since many government payments such as Social Security are based on the measured rate of inflation.

“Here’s the rule for bargains. ‘Do other men, for they would do you.’ That’s the true business precept.” Charles Dickens, Martin Chuzzlewit

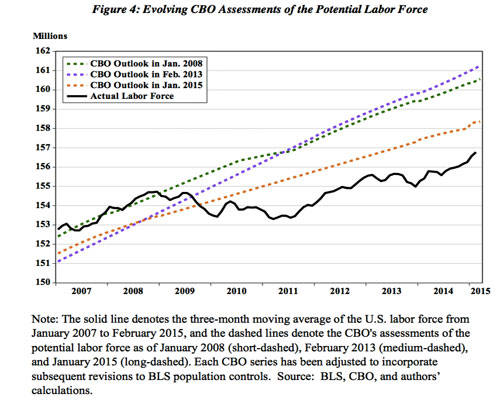

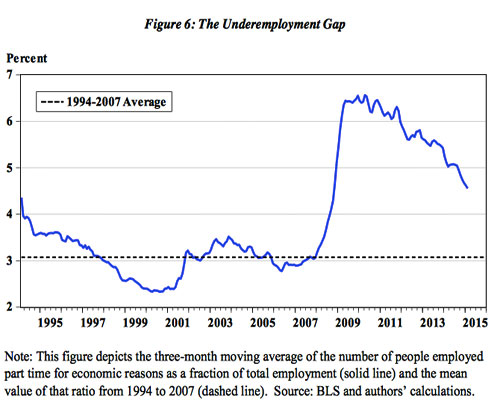

Unemployment destroys self-respect as well as income and family security. A recent article in FORBES highlights recent economic research that shows how officially measured unemployment can be too low especially during difficult economic times. Some workers, discouraged by their inability to find jobs, could drop out of the labor force. They would no longer be counted as unemployed. This “discouraged-worker” effect has been known for years. Other workers could be employed only part time when they would prefer full time employment. They, the “under-employed”, are also excluded from the official unemployment rate. The two charts below are reproduced from a paper by economists David Blanchflower and Andrew Levin. The first chart shows the difference between the “potential” labor force and the actual labor force. The difference is a measure of the discouraged worker effect. The second graph shows the “hidden unemployment” resulting from the underemployed. In recent years both impacts have been large, one reason voters may not “feel” as happy as the misery index would indicate they “should” feel.

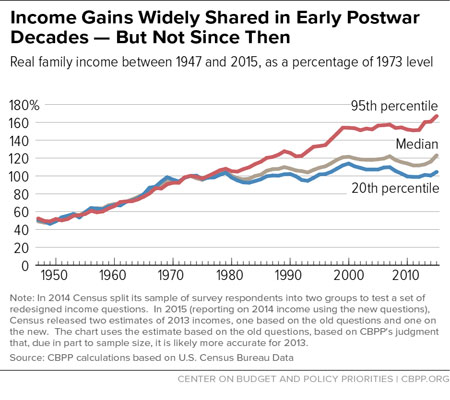

As far back as 1948 economist James Duesenberry developed his theory of the relative income hypothesis, an argument that people care about their own income relative to the income of their neighbors. This is an important concern today as inequality has grown more pronounced in America. Most of the benefits of economic growth have been going to the wealthiest Americans. [Watch HERE to see the income distribution in America change. Hat tip: Gary Evans at Global Macro Monitor.]

“Men were weighed by their dollars, measures gauged by their dollars; life was auctioneered, appraised, put up, and knocked down for its dollars.” Charles Dickens, Martin Chuzzlewit

“I am the only child of parents who weighed, measured, and priced everything; for whom what could not be weighed, measured, and priced, had no existence.” Charles Dickens, Little Dorrit

Given these few cursory observations, it should not be surprising that many voters don’t feel “better off” than they were a few years ago to paraphrase the words of President Reagan. So, they chose to “throw the bastards out” and to “drain the swamp” and to bring in a new set of alligators to replace the “experts.” Their success appears to have made Wall Street very happy as the Dow Jones has jumped over 10% since the November 4th low. [Note as Global Macro Monitor points out that Reagan got the same stock market bounce followed by a sharp 18% decline.] The question remains, what will happen when the high-5s stop and the real work of making America great … again … commences?

“So now, as an infallible way of making little ease great ease, I began to contract a quantity of debt.” Charles Dickens, Great Expectations

There are some concerns that could make the new President’s job difficult. I’m not talking about protests or obstruction by Democrats or anything that simple. When President Reagan was elected the national debt relative to our gross domestic product was below 40%. Today it is over 100%. President Reagan’s tax reduction policies and defense spending led to increased deficits and debt. He could afford a little of that although he did make changes to his policies in later years out of concern for a rising debt level.

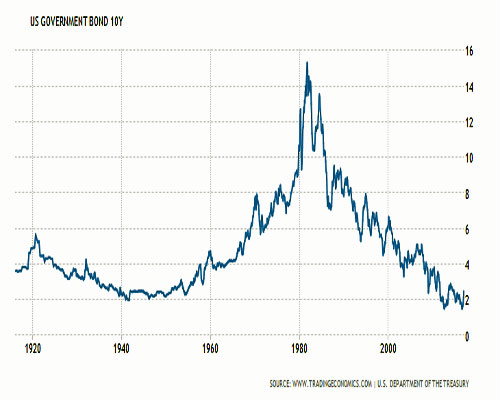

The economic cost of paying interest on the debt has been lessened in recent years by extremely low interest rates. In fact, we have had a great bull market in financial assets since Reagan’s presidency and steadily declining interest rates have raised the price of stocks and bonds and real estate as well as other assets. It is unlikely we will have this tailwind at our backs in the years ahead.

“The father of this pleasant grandfather, of the neighbourhood of Mount Pleasant, was a horny-skinned, two-legged, money-getting species of spider who spun webs to catch unwary flies and retired into holes until they were entrapped. The name of this old pagan’s god was Compound Interest.” Charles Dickens, Bleak House

“It was as true … as turnips is. It was as true … as taxes is. And nothing’s truer than them.” Charles Dickens, David Copperfield

Lower taxes and fewer regulations could certainly jumpstart the economy as Ray Dalio expects (SEE HERE). It sounds a bit like a voice from the past, Walt Rostow’s voice, the adviser to Lyndon Johnson whose Stages of Economic Growth talks about a “take-off” that mysteriously occurs when economies pull together all the necessary “preconditions” for growth. Somehow I worry that sky high debt levels and rock bottom interest rates, not to mention a gaggle of other problems honking their horns today don’t meet Rostow’s “preconditions”. By the way, top tax rates when Reagan assumed office were 70%. He reduced them to 28%. They have moved back and forth a bit since then are are around 39% now (although tax rates on capital gains are lower). I suppose we could reduce them to zero and run the government on largesse? Or, simply dispense with the government altogether as some libertarians would have us do.

SEE TAX RATES BY PRESIDENT HERE

In the aftermath of the election, many of the pundits President Elect Trump called the “biased” media have been scratching their heads in a furious attempt to find where they went wrong. One book that has taken America by storm is J.D. Vance’s Hillbilly Elegy (reviewed HERE).

A better book in my opinion is Joe Bageant’s Deer Hunting With Jesus: Dispatches From America’s Class War. Read the review by my friend and literary mentor, Eleanor Cooney, HERE.

“The education of Mr Jonas had been conducted from his cradle on the strictest principles of the main chance. The very first word he learnt to spell was ‘gain’ and the second (when he got into two syllables), ‘money’.” Charles Dickens, Martin Chuzzlewit

How Donald Trump will navigate his base while making America great … again … is not yet clear to me. I wish him well for we will all be impacted by his decisions. I’m sorry to say, I have my doubts. I will end this little essay on a personal note. Some friends asked me to come up with my predictions for the months and years ahead. What follows are my personal thoughts. I have no particular insight as to the future. I try to adhere to these eloquent words by Carl Sagan: “I try not to think with my gut. If I’m serious about understanding the world, thinking with anything besides my brain, as tempting as that might be, is likely to get me into trouble.” I fear that may have let my gut do much of my talking in the following remarks. You may wish to ignore them. You will probably be better off if you do.

PERSONAL THOUGHTS

What Trump will actually do and will be able to do (they are different precisely because running the government is not like running a business—a point lost on many) is quite vague at this point so my thoughts are obviously preliminary.

First, I don’t dismiss Trump out of hand or hope that he fails. The country needs a smart capable leader and executive branch always, more now than ever.

1. The most important thing a President does, can do, is set the tone. Trump appeals to our worst nature and uses it to manipulate the population at large. He has a lot of support, that’s true, but in too many cases that support seems based on that worst side of our nature: “lock her up,” “throw them out,” and so on. That worries me, seriously. it’s dangerous and I think it will lead to trouble. Maybe he will change after assuming office but I doubt it. So, he fails on setting the tone in my opinion and that’s his most important job.

2. His economic policies as far as I can tell (lower taxes, lower regulations, big infrastructure spending, tariffs) will increase an already out of control government deficit and debt and will increase our trade deficit. How long this will take depends on how much he can get done and how quickly. He wants it all and fast. So, maybe in the first year. But, surely by the second. These are not the results he, the Republicans, or his supporters want.

3. Jawboning individual corporations, running the government by Tweets, insinuations, threats, vindictiveness—these are not the signs of limited government or a free market ideology. They are the signs of a “malignant narcissist” using a friend’s term. Some would call it “crony capitalism”. Or, looking at the role his daughter and son-in-law are playing especially in the recent appointment of the ambassador to Israel, you might call it nepotism. Some combination of all three perhaps. This is dangerous and ultimately will not work. Keeping one’s options open can be a good thing but unpredictability is not a trait the rest of the world is going to be reassured by.

4. Many of the impacts of Trump will be long term negatives. Pushing our school system away from science and rational thought toward intelligent design and prescribed thinking will have far reaching negative results. Our school system needs reform, we all agree on that, but I see nothing in Trump’s early behavior or appointments to indicate that he understands the kind of change that will be effective in educating our young for the serious problems they will be facing. The push back toward carbon based fuels is a large step in the wrong direction. It will set back the progress we’ve made in renewable alternatives. Combined with a denial of climate change, a denial even to consider the impact an ever increasing and consuming world population has on the planet, Trump will be a disaster for the environment. Sure, he talked to Gore. He also talked to Quayle and he appointed avowed climate deniers and fossil fuel promoters. One of the reasons Russia likes him is that they need a higher oil price (as does Saudi Arabia and even Mexico for that matter.)

5. Countries that he flails against such as Mexico (I am biased on Mexico) will form other alliances. Mexico is our 4th largest trading partner, way ahead of Japan, yet we have a relatively modest negative trade balance with Mexico. China is our second largest trading partner and the largest foreign holder of our debt. Yes, America is the largest world economy, a beacon for democracy and freedom, and the most powerful military in the world but there are always other options. Mexico and China and even the European Union not to mention quickly growing LDCs will form other trading, political and military alliances if Trump continues to insult and threaten them as he is prone to do.

6. Domestically America is politically and economically divided. Obama did not heal this divide but he tried. He was thwarted at every step by a Congress that vowed on the very day he was inaugurated to oppose him at every step. Obama was not a deal maker, a negotiator, a Lyndon Johnson or Ronald Reagan. Neither is Trump. The Art of the Deal? What a joke. In business you have the luxury of going bankrupt. You don’t have to worry about the consequences of your actions other than how they might impact your sales or profits. You can afford to gamble. If you fail, you can write it off, pick up the pieces and start again. Can a country do the same? We are about to find out.

7. Compassion implies concern for others, for those less fortunate, less able, often with less opportunity. We need a leader with some compassion. I doubt Trump has any genuine compassion. He has showed that he lacks such throughout the campaign. Perhaps it was a show, to get him elected, to fire up his base. I think he is a cruel vindictive self focused human being. The American people and many of his base supporters are about to find this out. I don’t think they will be happy.

8. The country can move ahead, we can have a bull market in stocks, even some growth in the economy for a long time with such a president as the 1920s showed us So, I would not be so bold as to make short term predictions. And, as Keynes said, in the long run we are all dead. So hey, party while you can, every man for himself and the devil take the hindmost.

9. One more thing, Trump likes to double down. Ask smart stock traders what happens when you double down consistently.

ALL THE ABOVE PERSONAL COMMENTS ARE OFFERED IN MY HUMBLE OPINION. I COULD BE AND SURELY HOPE THAT I AM WRONG.

Hope that you are wrong? Good luck with that. I wouldn’t bet on it. Your excellently written description of him is sadly right on the money. All of those characteristics you’ve beautifully described, are so transparently clear.

Have some good holidays. And a Great Again New Year.