[Click on BLUE links for sources and more information]

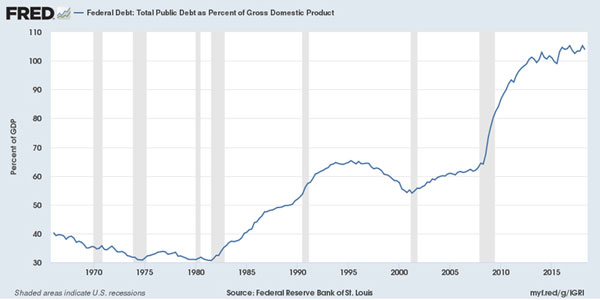

If you lower the price enough, consumers will buy more of the product. There are exceptions such as Giffen goods or Veblen goods but they are rare. It’s known as the law of demand. This is certainly the case with debt. As interest rates (the price of debt) steadily declined from the early 80s to the present, the national debt has skyrocketed relative to the economy. This is especially true over the past decade where taking on debt was encouraged by almost zero interest rates meant to spur the economy out of a deep financial recession.

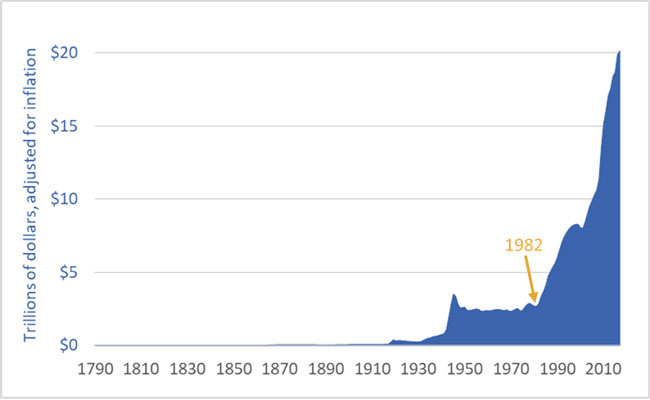

Source: Darrin Qualman https://www.darrinqualman.com/us-govt-debt/

US national debt is rising faster than at any time in history. Adjusted for inflation, the debt is seven times higher than in 1982 ($20 trillion vs. $2.9 trillion). Darrin Qualman

Our friends over at Global Macro Monitor have been all over this issue but we at Think in the Morning feel compelled to put in our two cents worth. This will be short but not sweet. For the longer version, go to Global Macro Monitor and read through their litany of facts. Yes, facts, not fake news.

Sea Gull Cellar Bar Napkin Art, Roy Hoggard artist

We have written on this subject before HERE and HERE. Sadly, things just seem to get worse.

According to the Chicago Tribune, Trump’s “greatest economy ever” doesn’t look so good under the hood. One problem, the tax cut (that primarily went to the top 1%) has increased the budget deficit (a lot) and thus the national debt. Another problem, wages have been slow to rise. Income and wealth inequality are at historically high levels. As ordinary people struggle to make ends meet, the low interest rates have encouraged them to take on more personal debt. And the low interest rates have also allowed corporations to load up on debt.

And in just two years, the government will be paying more in interest costs on the national debt than it spends on children, the report said. The data make clear “that policymakers are burdening our children with massive amounts of debt while doing little to invest in their future,” the report concludes. “This unfortunate combination threatens the long-standing practice in this country that each generation leaves a better world for the generation that follows.” Committee for a Responsible Federal Budget (USA Today)

The debt will be less of a burden if the economy grows at a rapid rate as it did in the second and third quarters of 2018. However, such rapid growth is not guaranteed. Even with rapid growth, the debt burden will increase if debt continues to be accumulated at current rates. The other ways to deal with the debt will be to repay it by reducing spending, inflating it away with increased inflation, or defaulting. Growing pension liabilities and other entitlements will make it difficult to reduce spending. The Social Security system is already in deficit meaning that it will be a drag on the government budget moving into the future. To make matters worse, a recent report on global warming indicates that an environmental headwind could substantially reduce economic growth.

Only a third of millennials own their own home, compared with almost two-thirds of baby boomers at the same age. It will take a millennial on average 19 years to save for a deposit, compared with three years in the 1980s. A third of millennials will, it is predicted, have a lifetime of renting with less space, poorer conditions, longer commutes and more insecurity than the baby boomers experienced. Yvonne Roberts, The Guardian

Sea Gull Cellar Bar Napkin Art, Karen Kesler artist

Even fiction writers are warning of the trouble to come. One millennial author, Daniel Torday, paints a dystopian future in his novel Boomer1.

Torday’s novel addresses the popular and wide-sweeping narrative that boomers are hunkering down with “all of the jobs” and refusing to retire, hogging all sorts of cultural space, and in doing so stunting the economic and emotional growth of the generation below them, some of whom are their literal children. In Boomer1, though, this leads to things getting quickly and dangerously out of hand. First the AARP website is hacked. Bob Weir’s home is vandalized. Iconic boomers Jann Wenner, Philip Roth, and Oprah are all doxed. An enterprising prankster breaks into the Eddie Bauer mainframe and makes it so that every item sold in its stores is marked $666.66. These attacks dominate the news; a (barely) fictionalized David Brooks writes a widely shared op-ed decrying “Millennials Gone Wild.” In the novel, persecuted boomers like Brooks start using a new phrase to describe the mayhem: “domestic generational terrorism.” Lindsay Zoladz, The Ringer

We don’t want to overplay the generational conflict anymore than we want to underplay it. Torday himself says:

This might be a good time to confess: I’m not even sure I believe in the concept of “generations.” It’s so broad as to be almost meaningless. The 18th century philosopher David Hume said something like, If humans, like insects, developed in generations that lived and died all at once, the concept might be useful. Instead we have government. So I think I just wanted to have a bone to throw out and let my characters fight over it. The book is told from three points of view—one of them Mark’s mother, Julia, who is solidly a Boomer, but has a complicated history. If I’m honest, I came to love her character maybe the most of any I’ve written. Daniel Torday interview

Sea Gull Cellar Bar Napkin Art, Sandra Lindstrom artist

Whether you think a generational war is coming or not, we can no longer ignore this:

Millennials are picking up the tab for the western world’s most stunning accounting disaster to date. No one expected people to live as long as they are, and in such great numbers. Pensions that were promised in the past, and seemed ordinary at the time, are now onerously over-generous, and that is hurting young adults today. Shiv Malik and Caelainn Barr, The Guardian

Sea Gull Cellar Bar Napkin Art, Jack Haye artist

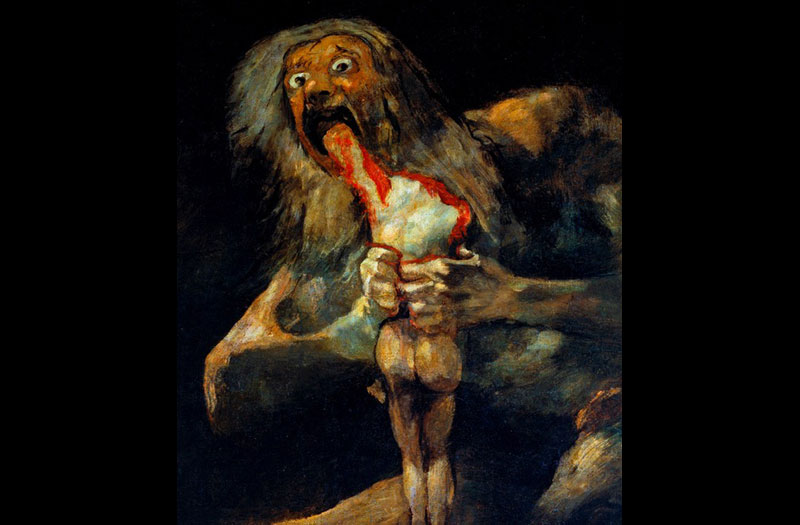

It’s long past the time we focus on the impacts, moral and otherwise, of “eating our children.” They have their own problems including student loans, credit card debt, employment prospects impacted by competition from not just aging Baby Boomers but also immigration, globalization, robots and inequality. Dealing with the mess their parents leave behind could push them over the edge. It’s time for more fact checking and less “feel good” fake news. Write that into your next tweet.

Baby boomers, who are retiring and expecting Social Security and Medicare, routinely punish politicians who acknowledge that the only way to get the nation’s fiscal house in order is to raise taxes and cut services. In the 1970s, baby boomers were not nicknamed the “Me Generation” for nothing … In addition to digging a financial hole, baby boomers are also creating an environmental deficit for millennials, the largest generation in American history. A U.N. report last week laid out the catastrophic economic and ecological damage that climate change will take on future generations if governments do not act quickly to cut carbon emissions by 2030. Chris Tomlinson, Houston Chronicle

Sea Gull Cellar Bar Napkin Art, Mariana Jones artist

Fact: GM announced today it is shuttering five factories. I thought factories were going to open, and open, and open, and open.. jobs were coming back to the U.S….after NAFTA was redone? Trump is a fraud. A Trojan Horse for the 1 percent to trick the working class. That is how the Dems should portray him and peel him off from his ‘Free Base.”

Great post, BTW, KD!

I am so tired of winning! (40 House Seats!)

You forgot to include the recipe for Ground Glass and Styrofoam Coffeecake!

A CANTICLE FOR LEIBOWITZ, here we come…