[Click on BLUE links for sources and more information]

Just then, Goldilocks woke up and saw the three bears. She screamed, “Help!” And she jumped up and ran out of the room. Goldilocks ran down the stairs, opened the door, and ran away into the forest. And she never returned to the home of the three bears.

Goldilocks and the Three Bears

What really happened to Goldilocks? Did she get off scot-free as in the modern version of the fairy tale? How did the three bears really react when they found out what she had done? Did they just shrug their furry arms and say “Oh well?” You can’t really believe that, can you? It turns out that Goldilocks didn’t get off so easily. Not in the earliest versions of the story. The happy ending was invented because mom and dad didn’t want to scare the kids. For the same reason a Goldilocks story was invented by stockbrokers and financial planners to encourage their clients to hang on when things go awry.

“The tale has apparently been around for at least two centuries, but with a different intruder in its earliest incarnations,” according to “History of Goldilocks & the Three Bears,” posted on the website SurLaLunefairytales.com.

British author and poet Robert Southey is often cited as the first to record a narrative form of the Goldilocks chronicle in “The Story of the Three Bears.” Southey’s original main character was an intrusive old woman. Over the years the character unfolded, becoming a likable but curious blond-headed girl.

As the story developed, writers explored different versions. Goldilocks became a tasty treat for the bruins in James Katzaman’s account.

“Oh my sweet lord, a human girl trespassing in our home,” Mama Bear exclaims in Katzaman’s rendition. At the sound of Mama’s voice, Goldilocks wakes up to be promptly eaten by the bears. That’s much more in tune with the oldest version I’ve been able to find.

In a 19th-century version recorded by Eleanor Mure, Goldilocks is tortured and killed by the bears for her transgressions. Sounds more like it to me. Mure wrote her version in 1831 for her nephew, Horace Broke (“Horbroke”) and it was not distributed to the general public. Thanks to modern technology that rare book is now available courtesy of the Toronto Public Library as a PDF File complete with Eleanor Mure’s beautiful watercolors some of which I’ve used in this post.

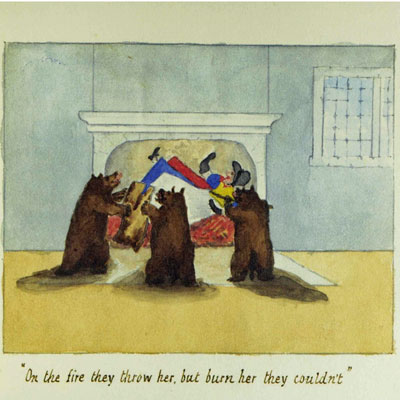

The bears catch Goldilocks in their house. Outraged, they first try to burn her alive.

Watercolor by Eleanor Mure

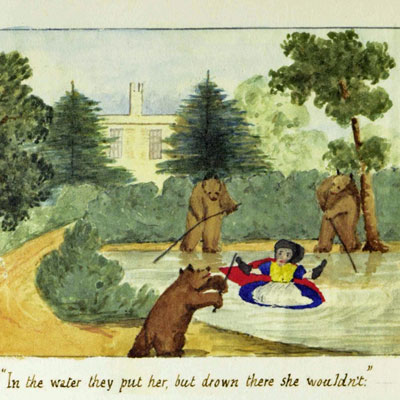

Watercolor by Eleanor Mure

Apparently, bears are not very good at fire, so this doesn’t work, and the bears change tactics and attempt to drown her.

Watercolor by Eleanor Mure

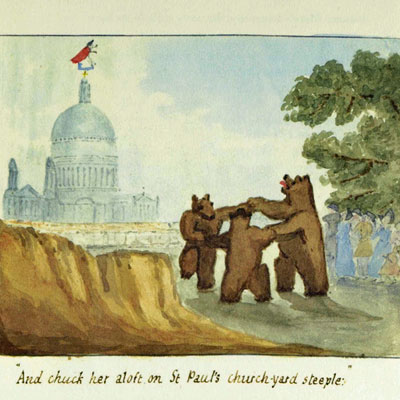

This doesn’t work either. The bears get frustrated. Finally they succeed by impaling Goldilocks atop a church steeple.

Watercolor by Eleanor Mure

The British novelist and poet, Roald Dahl, wrote a poetic version. He doesn’t spare the tender feelings of our little ones as you can see by the ending.

… A judge would say without a blink

“Ten years hard labour in the clink.”

But in the book, as you will see

The little beast gets off Scot-free

While tiny children near and far

Shout, “Goody-good! Hooray! Hurrah!

Poor Darling Goldilocks,” they say,

“Thank goodness that she got away.”

Myself, I think I’d rather send

Young Goldie to a sticky end

“Oh Daddy” cried the Baby Bear

“My porridge gone, it isn’t fair!”

“Then go upstairs,” the Big Bear said

“Your porridge is upon the bed

But as it’s inside mademoiselle

You’ll have to eat her up as well.”

That seems much more life-like doesn’t it?

This makes perfect sense. After all, Goldilocks is guilty of four crimes, breaking and entering, stealing, destruction of property, and vandalism.

Stock market declines are called “Bear Markets”. I think you will agree that’s entirely appropriate now that you know the real story of Goldilocks. Goldilocks is often used as a financial term by the market gurus. We talk today about a Goldilocks economy, an economy that is not so hot that it causes inflation, and not so cold that it causes a recession. Some think we are in such an economy today. Some attribute the rising stock market to favorable Goldilocks conditions.

Knowing what happened to Eleanor Mure’s Goldilocks should give today’s market enthusiasts some pause. One must naturally ask if the Goldilocks economy will be impaled on the church steeple as was Goldilocks in the older version of the story. Of course it will, sooner or later. But when?

The Goldilocks story brings to mind the great tribute to the Day of Atonement (Yom Kippur) in the song Who By Fire by the late Leonard Cohen.

Yes, who shall I say is calling? Who indeed? Or shall we ask what is coming, bull or bear?

Large market declines and extended Bear markets do not happen often. On average they seem to occur every 8 years on average. Even the best economists have a hard time predicting them. Around this time [88 years ago just before the Great Depression], Yale economist Irving Fisher was jubilant. “Stock prices have reached what looks like a permanently high plateau,” he rejoiced in the pages of the New York Times. That dry pronunciation would go on to be one of his most frequently quoted predictions — but only because history would record his declaration as one of the wrongest market readings of all time.

“History doesn’t repeat itself but it often rhymes.” It’s been 8 years since the last Bear Market. (See A History of Bear Markets From the Great Depression). Is it time for another? Not necessarily. As you can see from the chart, nothing is average.

According to economist Robert Shiller:

… the U.S. stock market today looks a lot like it did at the peaks before most of the country’s 13 previous bear markets. This is not to say that a bear market is guaranteed: Such episodes are difficult to anticipate, and the next one may still be a long way off. And even if a bear market does arrive, for anyone who does not buy at the market’s peak and sell at the trough, losses tend to be less than 20%.

But my analysis should serve as a warning against complacency. Investors who allow faulty impressions of history to lead them to assume too much stock-market risk today may be inviting considerable losses.

Sea Gull Cellar Bar Napkin Art, Bob Avery artist

On the other hand, investment analyst and financial adviser Ken Fisher is very upbeat. See his recent Stocks Were Strong in 2017, Expect More Growth in 2018.

At the moment FOMO (fear of missing out) does seem to be in control according to Bloomberg. (Are You Missing Out on the Great Market Melt-Up?)

“Unlike other FOMO-driven rallies of the distant and not-so-distant past—from Dutch tulip bulbs in the 1600s to dot-com stocks at the turn of the century to the Great Bitcoin Craze of 2017—there’s little debate that there will be something legitimate to miss out on in the stock market in the near term, rather than the hazy distant future.

Forget about the economy. The massive tax cuts President Trump signed into law on Dec. 22 will probably boost gross domestic product growth by a few tenths of a percentage point, but that’s not what investors are excited about. As economists gently inch up GDP estimates, equities strategists may find themselves stepping over one another to jack up their forecasts of different parameters: the benefits to corporate profits, the subsequent cash returns to shareholders, a return of confidence and greed to the collective investor psyche—and good ol’ FOMO. The wholesale dismantling of Obama-era regulations adds a hard-to-quantify, but real, fuel to the fire.

The average estimate of strategists surveyed by Bloomberg on Jan. 8 is for the S&P to end just below 2,900 by next New Year’s Eve. If the rally continues at anywhere near the breakneck pace with which it started the year—up almost 3 percent in the first four sessions of 2018—it will hit that yearend forecast before Groundhog Day. Some measures of upward momentum in the market are at the highest in half a century or more, and often the strong momentum generates more strong momentum.”

No matter who says what, always remember, no one can predict when the next Bear Market will occur. Nor is it easy to react to a market decline when it does come. On just one day in 1987 (October 19th) the market fell over 22%. The best one can do is to be vigilant and aware of the risks of investing. Eventually the stock market has, so far, always recovered and gone on to new highs. But, that can take some time. If you choose to take the risk, make sure you can comfortably wait for the recovery. You don’t want to get caught asleep when the bears come home to roost.

Sea Gull Cellar Bar Napkin Art, artist unknown

Not sure if there is a way out of this asset bubble as it is so massive and is global in nature — “the everything bubble.”

This may be “the one”. The central banks have shot their silver bullet.