Financial advisors would have you believe they inhabit an arcane world of alphas and betas and that they and they alone can navigate the mysteries of modern portfolio theory. The reality is a bit different. Let me tell you about an average day in the life of the man or woman who purports to manage money.

What they actually manage is you, and you are very difficult to manage indeed.

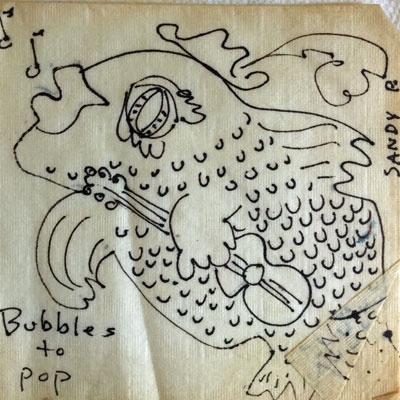

Sea Gull Cellar Bar Napkin Art, Suia and Sandy artists

My first client was a tobacco-chewing redneck hippie with a great disdain for the economic system he wanted me to manipulate on his behalf. In the midst of our discussion about his risk tolerance, I noticed his mouth was full of tobacco stained saliva that was dripping at the corners and rolling down his chin. There was a door leading from my office to a deck with a beautiful view of the ocean. I suggested we interrupt our discussion to take a look. It was a timely suggestion. He managed to spew the entire gob over the deck before disaster struck. I sold him government bonds, safe and guaranteed. This was the mid-80s when the ten-year paid about 8%. He was happy as a clam.

He sent me a friend who walked into the office and said in a tone that indicated he was all business: “Gimmee some a them bonds James tole me about.” I asked him how much he wanted to invest. He pulled out a stack of crumpled hundred dollar bills and counted out twenty thousand right on the spot. I said I couldn’t accept cash. I could only take a check.

“Well, if I ain’t be damned …” he snarled and stormed out of the office. I didn’t see him again.

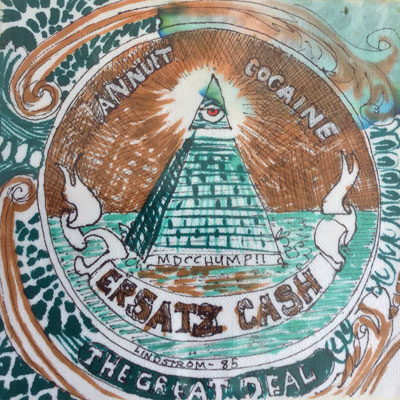

Sea Gull Cellar Bar Napkin Art, Sandra Lindstrom artist

He wasn’t the only one. There was a lot of cash lying around in those days. I remember when I was in the restaurant business before I became a financial adviser (the best financial advisers are used car salesmen, ex-military, and retired restaurateurs according to ED Jones). The boys would come in and buy everybody drinks with hundred dollar bills that smelled moldy as if they’d been buried in a coffee can for months. They had. There was literally money growing on bushes back then. Those were the days.

Once a large woman with a pleasantly southern lingo dropped by to invest in gold. She said God had told her to invest in gold. She wondered what I thought of it. I said gold might be okay in a diversified portfolio. 5% or so would be a reasonable position.

“No, no, no. God told me to put everything in gold, all the money I’ve got, honey.”

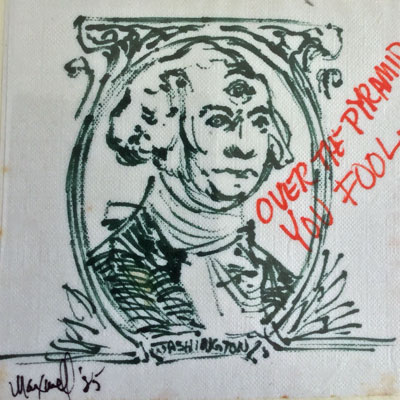

Sea Gull Cellar Bar Napkin Art, James Maxwell artist

“How do you know God told you this?”

“It came to me in a dream.”

“In a dream?”

“Yes baby, that’s how God communicates. It’s in the Bible too. Gold and silver are mentioned all through the Bible. Paper money isn’t mentioned even once.”

“Is that right,” I said. Paper money wasn’t invented until years after the Bible was published by the four evangelists.

“Sure is, honey.”

I liked the way she called me honey, but I couldn’t help her.

“I’m sorry but I don’t sell gold.”

“You don’t sell gold?”

“No ma’am.”

“Well then, what do you sell?”

“Stocks and bonds.”

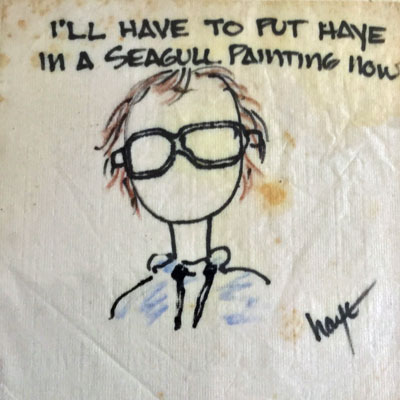

Sea Gull Cellar Bar Napkin Art, Jack Haye artist

Her pretty eyes looked out at me from under expert smears of mascara.

“I’m so sorry I wasted your time, honey. I better be on my way.”

“Yes, I think that would be best. You don’t want to … well, you don’t want to go against God.”

“I sure don’t,” she said with conviction as she walked out of the office.

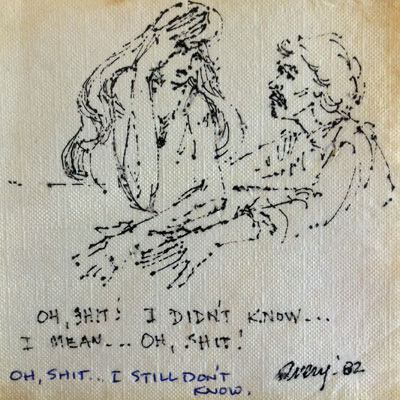

Sea Gull Cellar Bar Napkin Art, Bob Avery artist

One thing I don’t like is when someone leans back in a chair and rocks it back and forth on the two back legs. I purchased some furniture once from Scandinavia Design. Little wooden pegs and screws were used to hold the chairs together. This one client, a big jovial guy, rocked back in his chair and the whole thing exploded dumping him onto the floor. Luckily the carpet was pretty soft and he wasn’t injured. Or maybe he was just too embarrassed to admit that he was.

That poor guy was my bad luck client. One day I had my dog in the office. Sometimes I had to do that when there wasn’t anyone to take care of her. She was a little black, brown and white bulldog beagle mix. Her name was Mocha. She was a good dog but she really hated men for some reason. I think she might have been abused as a puppy. Anyway, this guy, the same guy who exploded the chair, came into the office. Before I could warn him, he reached down to pet Mocha. She lashed out and bit his hand. Thankfully she didn’t draw blood or worse. He was understandably shaken but just like with the chair he didn’t make a big deal about it. I was lucky.

Sea Gull Cellar Bar Napkin Art, Jack Haye artist

I don’t know if you remember all the fear and angst about Y2K, the year 2000. Everyone was afraid the computers would stop working, records would be forever lost, the trains would stop running and the planes would stop flying. I put together a flyer and sent it out to clients with a list of recommendations in an attempt to keep them calm. There was one female client well into her 80s that I adored. She was a voracious reader. She read everything, even the prospectuses for the mutual funds, the annual reports, and the details about upcoming board meetings and so on. She would call with complicated questions that I did my best to answer. Just before Y2K she called to say she’d read my flyer and taken it to heart, particularly the part about making sure to buy enough champagne before the usual run on New Years Eve.

“Can I ask you something, David?”

“Sure, go ahead.”

“Do you have any aches and pains at your age?”

“Oh sure, I’m not that young, Lillian. I’ve got arthritis because of the sports I played way back in high school.”

“What do you do for it?”

“Oh, just deal with it as best I can. Sometimes I take ibuprofen, nothing too dramatic.”

“You know, nothing works like the booze.” That’s when she told me she bought the store out of champagne a week before the New Year. “That’s the best advice you’ve given me, David. I sure do appreciate it.”

Sea Gull Cellar Bar Napkin Art, Sandy artist

Y2K came and went with nary a problem and everyone soon forgot about it. But, that champagne went right on working.

Some investors are superstitious. They don’t buy stocks on certain days or at certain hours of the day or at certain times of the year. An entire industry has developed to accommodate this type of investor. I first became aware of it when I read The Stock Trader’s Almanac by Yale Hirsch. He wrote a book called Don’t Buy Stocks on Monday where he summarized a number of technical factors based on stock market statistics over the years. There are those who swear by it.

I asked a friend in the investment business about technical analysis. He explained it like this.

Imagine two men, mathematically inclined, sitting in chairs. A ways away is a cliff and they can’t see anything below the cliff. Periodically they see poles bobbing up and down. They decide to try to predict the motion of the poles. They look for trends, for certain predictable formations, and so on. They spend quite a bit of time and energy on this and finally decide they have a dependable model that can with reasonable accuracy explain the ups and downs of the poles.

A third man comes walking along. His knowledge of mathematics is elementary. They tell him they can predict the movement of the poles with their model.

“No kidding,” he says looking a bit skeptical.

“No kidding,” they say, “Watch. Those poles are now in an up trend. They will remain that way until we get a ‘head and shoulders’ pattern which will signal a reversal of the trend.”

“Is that so?” The third man carries a bucket of food scraps toward the cliff. He throws them over the side and all the poles immediately disappear.

The two men are dumbfounded. This was impossible according to their model.

The third man watched them argue with amusement. “You know what’s at the bottom of that pit boys? A bunch of pigs with poles attached to their necks. They’re rooting through piles of garbage for something to eat.”

“That’s technical analysis in a nutshell,” said my friend.

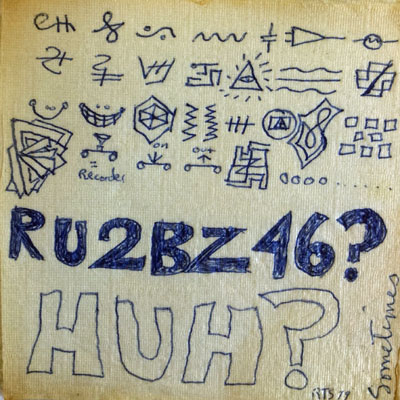

Sea Gull Cellar Bar Napkin Art, artist unknown

One of my clients, a young woman, was furious at her ex-husband. She had just gone through a painful and bitter divorce. She came into the office insisting that she would rather make her dog the beneficiary of her IRA than let her ex-husband have a dime.

She wanted to know if that was possible.

“Not really,” I said. “But there’s something you could do.”

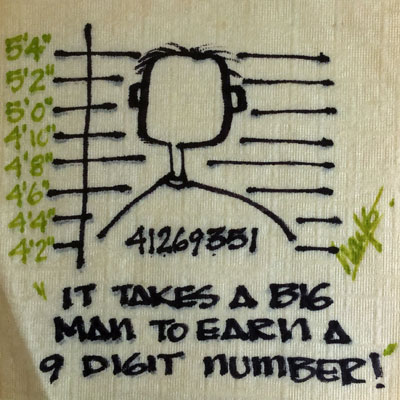

Sea Gull Cellar Bar Napkin Art, SP artist

“What’s that,” she asked, her pretty blue eyes watching me anxiously.

“You can’t make your dog the beneficiary but you can appoint the SPCA as beneficiary.”

She was delighted. We made the necessary changes on her account. She sent me a bottle of wine in appreciation.

One young man smoked a joint whenever he had an important investment decision to make. I told him he couldn’t smoke in my office so he went out on the deck. He invested regularly into his IRA. Sometimes he had more to invest than the maximum allowed in the IRA. He put the extra money into an individual account where he picked stocks. His money grew year after year like clockwork. One day he called and told me to liquidate everything immediately and send him the cash.

“Are you kidding? You’ll have to pay taxes on the gains and penalties on the IRA for early withdrawal.”

“Just send it,” he said.

I tried to send it out to him but was told the account was frozen.

“Frozen?” I was amazed. “What do I tell my client?”

“You can’t tell him anything,” said the attorney from the compliance department.

“I’ve got to tell him something. He’s a good client.”

The attorney consulted with some other attorneys then said I could tell my client that the District Attorney of Mendocino County had put a freeze on the account. He said the client would understand.

As it turns out, my client’s girlfriend slipped and fell in his garden seriously hurting her head. He called the local fire department for assistance. They arrived and discovered the garden was a giant marijuana patch. He’d been growing marijuana for years, legally he said, selling only to the legal medical marijuana outlets. It didn’t matter, he lost all his investments and ended up in jail. It was a terrible thing. I felt awful for him.

A young couple came in one day. They wanted to start investing for their future. It always amazed me when I encountered such responsible behavior in young people.

I asked them: “How much have you saved up?”

“Nothing yet, but we’ll start saving right away,” said the girl. She seemed very confident. The boy didn’t seem as sure.

Sea Gull Cellar Bar Napkin Art, Jack Haye artist

The next month they came in with a few hundred dollars. Then, to my great surprise, they came in every month with more money, lots more. After my experience with the marijuana farmer, I grew suspicious.

My worries got the best of me. I had to confront them. “Can I ask you a question?”

“Go ahead, shoot,” said the young man.

“Where exactly is all this money coming from?”

The boy turned bright red and clammed up.

“Oh, that’s easy,” said the girl. I told him the only time I’d have sex with him was each time we’d saved up a hundred bucks.”

Needless to say, they became one of my best clients.

Some people will invest in the worst investments you can think of to lower their taxes. Others, like my mother who made dinner based on what she saw on TV that afternoon, will invest in the next best thing according to Jim Cramer on Mad Money. But, when it comes down to it, the sex thing beats all. No pun intended. And remember, if that stops working, there’s always the booze.

Really enjoyable. Thanks!

When I first moved here, I needed to fax you an important paper. The closest fax was the Albion Gro. Having never sent a fax, I asked for a copy before they sent it. In retrospect, I don’t know where that paper was going…through the wire? I’m glad that story didn’t show up in your blog, but equally happy that you have such great stories to share.

Thanks Jean, I’m also happy I still have them to share.