(Trump Family Amasses $5 Billion Fortune After Crypto Launch – WSJ)

According to historical records, the Dutch purchased Manhattan from the Lenape people in 1626 for approximately $24 in wampum (beads). Wampum was not originally “money” but was a symbolic medium for certain native American peoples, especially the Lenape and the Iroquois. It was used in diplomacy, treaties and storytelling where strings and belts encoded oral histories and agreements. Unlike wampum, crypto never had cultural or symbolic meaning before becoming “money.” Its mythology was constructed after the fact by its users. However, there are great similarities between wampum and crypto (cryptocurrency).

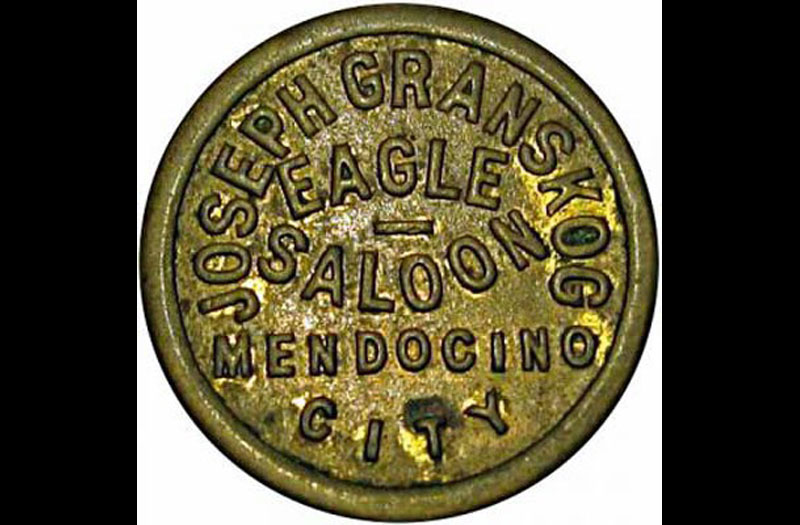

There are obvious advantages to printing your own money. When Joseph Granskog minted some 5 cent tokens for his Eagle Saloon in Mendocino around 1909, they circulated around town as if they were money. The cryptocurrency (bitcoin, ethereum, stablecoins, etc.) of today are a sophisticated advance on that idea, but in many ways cryptocurrencies function very much like the wampum of 1626 or the 5 cent tokens Granskog minted for his Eagle Saloon. What many do not understand it that crypto is not money, doesn’t function like money, and is not regulated like money. To some, that is its appeal. To others, that is its downfall.

Cryptocurrency, or crypto, is a form of digital or virtual currency that uses cryptography (advanced mathematical techniques) to secure transactions, control the creation of new units, and verify the transfer of assets. Unlike traditional money issued by governments (like dollars or euros), most cryptocurrencies are decentralized and operate on a technology called blockchain.

In 2018, Nobel Prize winning economist Paul Krugman described Bitcoin as “a bubble wrapped in techno-mysticism inside a cocoon of libertarian ideology.” He dismissed its utility in economic transactions calling it a step back toward gold-era money. Since then cryptocurrency has increased tremendously in popularity despite Krugman’s concerns. Among U.S. investors with $10,000 or more in financial assets, cryptocurrency ownership has increased from 2% in 2018, to 6% in 2021, and now sits at around 17%. An independent study by Security.org estimates that 28% of U.S. adults (about 65 million people) now own cryptocurrencies, up from roughly 15% in 2021.

Many investors in cryptocurrency have lost money. A study by the Bank for International Settlements found that for Bitcoin, the median investor lost around $431 of their total $900 investment, nearly half their money. Where investments were ongoing and frequent, losses were even more widespread. According to a Lending Tree survey, among Americans who have held crypto, 38% sold for less than they paid, whereas only 28% profited. Another 13% broke even. Large investors, especially professionals, and investors who held over the long run have seen substantial gains but that excludes most investors. Bitcoins growth from 2023 to late 2024 surged nearly 500% showing how early or well-timed entries could produce hefty gains.

Retail investors, particularly those jumping in during euphoric highs, have more often lost money than made it. Professional players, institutional funds, or early adopters entering on dips have realized substantial profits. The overall picture suggests crypto is not uniformly profitable. It’s highly dependent on timing, strategy, and luck.

President Trump has taken actions that align closely with cryptocurrency interests, actions that have contributed to his family potentially making billions of dollars of profits. He has publicly embraced crypto, signed executive orders to establish a strategic Bitcoin reserve and a U.S. asset stockpile. He signed the GENIUS Act, purportedly to regulate stablecoins and the crypto environment in the U.S., but many including Krugman and Senator Elizabeth Warren argue that the regulations and rules are weak. Trump’s family holds and has benefited from crypto assets such as the WLFI tokens and $TRUMP meme coin. But the real money maker for the Trump family is the World Liberty Financial crypto exchange where commissions are paid to the Trumps on every buy or sell transaction. The exchange profits off volatility and the churn regardless where the prices of crypto go. According to Senator Warren: “For the first time … this bill will make our president … the regulator of his own financial product. The GENIUS Act will accelerate Trump’s corruption by supercharging … the reach and profitability of Trump’s USD1.” Krugman highlights how the Act offers the crypto industry a comprehensive regulatory structure—yet one that may legitimize risky shadow banking practices without meaningful consumer protection. He suggests Washington has become “a town … largely bought and paid for.”

Billionaire investor Ray Dalio says: “Crypto is now an alternative currency that has its supply limited, so, all things being equal, if the supply of dollar money rises and/or the demand for it falls, that would likely make crypto an attractive alternative currency. I think that most fiat currencies, especially those with large debts, will have problems being effective storeholds of wealth and will go down in value relative to hard currencies”. Dalio pinpointed several forces that influence the relative value of the dollar including debt cycles, internal political divisions, geopolitical rivalries, and natural shocks like climate change. The Trump family has a vested financial interest in seeing that all of these forces come to bear.

While there’s no proof of an explicit scheme to weaken the dollar to enrich crypto holdings, some observers suggest a subtle strategic alignment. The U.S. Dollar Index (DXY), which tracks the dollar against six major world currencies, dropped approximately 10.8% in the first half of 2025, marking the steepest six-month decline since 1973. Tariffs, erratic behavior, a high and growing national debt, and threats to institutions like the Federal Reserve have spooked investors, undermining confidence in U.S. stability, leading to a weaker dollar. Analysts warn that persistent uncertainty may weaken the dollar’s longtime dominance, affecting U.S. borrowing costs, import prices, and living standards.

Crypto is not “legal tender” i.e. money that must be accepted if offered in payment of a debt. It is “property” not “money” under federal law. The IRS taxes crypto as property meaning capital gains rules apply when you sell, trade, or even spend it. Only two countries (El Salvador and the Central African Republic) have declared Bitcoin legal tender. If crypto did become legal tender nationally, it would fundamentally reshape U.S. monetary policy, tax law, and even the dollar’s global role. If cryptocurrency replaced the U.S. dollar as the primary medium of exchange, the consequences would be profound, touching every aspect of the economy, politics, and global power. It wouldn’t be purely “good” or “bad.” It would create winners and losers depending on who controls the new system and how prepared society is. Some potential benefits could include decentralization of the money supply, inflation resistance, and faster, cheaper transactions. Some potential risks could include extreme volatility, loss of monetary policy to guide the economy, and deflationary spirals similar to what we saw when the U.S. was on a gold standard during much of the 19th century.

Economist Paul Krugman once described crypto as a collectible bubble. Like Beanie Babies or tulip bulbs, crypto’s price depends on finding someone else willing to pay more. If collective belief fades, there’s no fallback “use” to support value. Crypto is often compared to gold but gold has some industrial uses and tangible properties in jewelry and electronics that Bitcoin lacks. Crypto, like AI, is energy intensive. Krugman characterizes the crypto industry as a “hyper-powered example of predatory finance, influence-buying, and corruptions,” and he warns about inequality and systemic risk. He has said that crypto poses significant financial risks reminiscent of historical bank failures, especially given light regulation and the blurred boundaries between crypto and traditional finance.

In a recent Substack post (Digital Corruption Takes Over DC), Krugman argues that stablecoins lack any meaningful utility compared to conventional payment systems: “They (stablecoins) can’t be used to make ordinary purchases, and there’s nothing you can do with them that can’t be done more cheaply and more easily with debit cards, Venmo, Zelle, wire transfers, etc. In other words, the only economic reason for stablecoins is to facilitate criminal activity.”

The history of the $TRUMP and $MELANIA meme coins show how volatile these assets can be:

| Token | Launch Price | Peak Price | Current Price | % Decline from Peak |

|---|---|---|---|---|

| $TRUMP | ~$7–$10 | ~$75.35 | ~$8.40 | ~88% |

| $MELANIA | (Unknown) | ~$13.73 | ~$0.20 | ~98% |

Both meme coins experienced massive hype-driven surges at launch, with $TRUMP peaking in the tens of dollars and $MELANIA also reaching double-digit highs. But by mid-2025, the market has largely moved on—$TRUMP is a fraction of its peak price, and $MELANIA has collapsed even further, losing nearly all speculative value. Yet, the commissions on any trades of these coins keep rolling into the Trump family’s World Liberty Financial regardless of the prices they trade at.

Whether for better or worse, there is little doubt that crypto is growing in use and acceptance. What the ultimate impact will be remains to be seen. Thus far, those who have profited the most include the Trump family and the wealthiest Americans. Like the Lanape people, the rest of us are likely to be stuck with a few worthless beads. That 5 cent token minted by Joseph Granskog can no longer be exchanged for a drink at the Eagle Saloon which is long gone, but it’s worth more than the two Trump meme coins.

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency,” said the famous economist John Maynard Keynes. He attributed the phrase to Vladimir Lenin though it is uncertain of Lenin actually said it. The Wampum-ization of the American economy is moving forward. Stay tuned.

All I can say is I’m glad I won’t be around for the full-on FAFO when people wake up to the reality that they have lost everything including their minds.

Already there NB.