[First published in the Real Estate Magazine, April 1998, revised 2016]

I obtained the following definitions from the American Heritage Dictionary:

GEEK: A carnival performer whose act usually consists of biting the head off a live chicken or snake.

GURU: A spiritual teacher; a charismatic leader or guide.

These aren’t exactly the definitions I had in mind; let me explain. Geeks are the investment statisticians of the financial world. They are satirized as pointy-headed academics that enjoy staying up late at night working on mathematical puzzles. Many geeks are brilliant but miss the ordinary things in life that the rest of us take for granted. Economists are geeks as are inventors and entrepreneurs, mathematicians, and scientists. Geeks can win Nobel Prizes but seldom win beauty contests. They are fascinating but also tedious. Gurus are the celebrities of the financial world. They believe and want you to believe that they’ve found the secret to success and can help you find it too. Unlike geeks who test obtuse hypotheses with modern statistical methods, gurus tend to speak in rather simple terms that investors can understand.

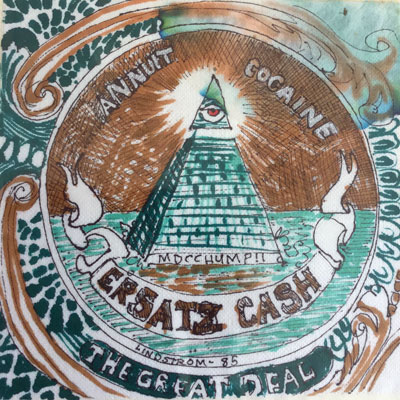

Napkin Art, Sea Gull Cellar Bar, Sandra Lindstrom artist, Kelley House Collection

The problem with gurus is they can’t live up to expectations. Even if they have a good system, success ultimately breeds failure because of hubris. Geeks have statistics on their side, but they’re boring. Gurus can hold the attention of a crowd like “a spiritual teacher; a charismatic leader or guide.” We all want to believe some guru has a magic diet pill that will painlessly turn us into lean, mean, beautiful machines, but some geek always comes along to remind us that diet and exercise, torture actually, are the only things that really work. Even if gurus fall short of our expectations, they are fun and they make our world interesting even if they often make inane comments like: “confusion over the implications of the jobs report, uneasiness over the land of the sinking economy (a/k/a Japan) and a touch of buying fatigue contributed to Friday’s blah market performance.” [Alan Abelson, BARRONS, April 6, 1998, page 4]. Sure, and everything else going on that day contributed too.

Gurus can be quite direct. Therefore, when they get things right, as they do periodically, they can have a powerful effect on your psyche. It’s as if they have some special insight or wisdom into life. Alas, they don’t. Gurus actually get their ideas from geeks as the famous economist John Maynard Keynes explained six decades ago: “Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.” Keynes was a geek who achieved guru status. Not every geek can make that transformation.

It’s easy to make fun of geeks. Don’t. They do useful work. But, they don’t have access to a magic pill anymore than gurus do. “The trouble with economists,” says economist Richard Thaler, “is that they assume the world is as rational as they are.” [Gene Epstein, BARRONS, April 6, 1998, page 42] There are reams of journal articles and textbooks expounding on geek investment theory. The basic message is fairly straightforward. The market is efficient. Relative stock prices reflect all known information and are rational because hordes of geeks are making lightening speed calculations every minute of every day to make sure that this is true. The smartest geeks can make profits in the market if they have superior intellectual capacity, but the rest of us, including the guru portfolio managers, are unlikely to do better than the market averages. After all, the average comes from our mass homogenization. Geeks recommend investors focus on a portfolio of index funds.

Napkin Art, Sea Gull Cellar Bar, James Maxwell artist, Kelley House Collection

It takes a buyer and a seller to make a market and that’s where the gurus come in. The gurus promise better performance. Some deliver. The problem is the winners change each year, and the ultimate winner is unpredictable. Investors who want guru managers have the difficult task of deciding just which gurus to hire. You can’t hire all of them. Even if you could you would just be back to an index, albeit a convoluted and expensive one at that! Entire industries including the financial services industry have evolved to help investors make the proper guru selection. Yes, you can do this on your own just like you can write your own will or do your own taxes, even cut your own hair if you have the time, the expertise, and the interest. Using a professional advisor may save time, money, and trouble provided the advisor has your best interests at heart.

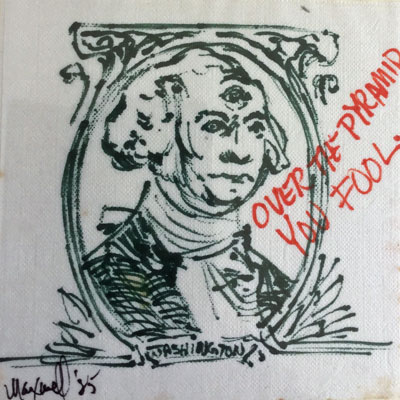

Napkin Art, Sea Gull Cellar Bar, James Maxwell artist, Kelley House Collection

So how should you invest your hard earned money, with the geeks or the gurus or neither? The choice isn’t mutually exclusive. A well-designed portfolio anchored with index funds supplemented with a few carefully chosen guru managers is one possible start. But, there is list of rules you should follow:

1. Make sure you truly understand the risks of each asset class and adjust your portfolio so that you are comfortable with the downside risk.

2. Understand that stock prices are not predictable. If you time the market at all, make small, not large, bets.

3. Occasionally rebalance your portfolio when one asset class substantially outperforms another.

4. Unless you have a high tolerance for risk, stay diversified even if this hurts performance in the short run.

5. Have reasonable expectations especially when making retirement projections.

6. Note that while gurus may seem larger than life they actually deserve our pity because they often come to tragic ends.

7. Remember that the world is full of surprises and that geeks are constantly changing their theories as the future unfolds.

Even geeks have the occasional urge to speculate. We all do. Consider Paul Samuelson’s Secret. Samuelson was geek like Keynes who achieved guru status. I had the honor of tutoring his daughter, Jane, in mathematics for a short time when we were attending the same college. Sadly there were no stock tips involved. There might have been barring the legal complications. According to David Warsh: “It turns out that the great MIT economist was influential in the creation of one of the earliest and most influential hedge funds.” While Samuelson wrote about and believed in the efficient market hypothesis, he did not entirely stick to the index fund investing mantra that emerges from that hypothesis. But, he was no wild man. He chose his bets carefully and limited them to a percentage of his portfolio while paying attention to the rules above.

If you fail in your investing, don’t blame the gurus or the geeks. “The fault, dear Brutus, is not in our stars, But in ourselves, that we are underlings.” [Shakespeare, Julius Caesar]

Napkin Art, Sea Gull Cellar Bar, James Maxwell artist, Kelley House Collection